According to Statista, Walmart ranked first among the 100 leading retailers in the US in 2023, with retail sales of about $533.96 billion.

Target comes 7th on the list with retail sales of about $105.84 billion.

While Walmart and Target have unique characteristics that differentiate them, they also share similarities in their approaches to grocery sales, omnichannel strategies, private label offerings, etc.

This blog, a comprehensive Walmart vs. Target comparison, will be a valuable resource in your attempt to understand the American retail market.

We obtained the POI data required for this comparison from the ScrapeHero Data Store.

If you are looking to download accurate, updated, affordable, and ready-to-use POI location data instantly, ScrapeHero Data Store is for you.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

Are There More Walmarts or Targets in the US?

Since Walmart is a retailer with a bigger market share, it will likely have more stores than Target.

This is because a larger number of stores can contribute to a higher market share by reaching more customers and generating more sales. But how many?

Walmart has 4,610 stores in the US, whereas Target has only 1966 stores. So, yes, there are more Walmart stores than Target in the US.

Download the complete list of all Walmart stores in the US instantly!

Walmart vs. Target: States With More Stores

While Walmart and Target have presences across the US, they are differently distributed across different states.

Some states have more Walmart stores, while a few others have more Target stores.

So, we gathered Walmart’s and Target’s number of stores in each state and compared them to see which retailer had more stores in each state.

It turns out Walmart has more stores than Target in the majority of the US states.

However, it’s important to note that Target stores dominate over Walmart in four US states: California, Minnesota, New York, the District of Columbia, and Massachusetts.

Want a complete list of Target store locations in the US?

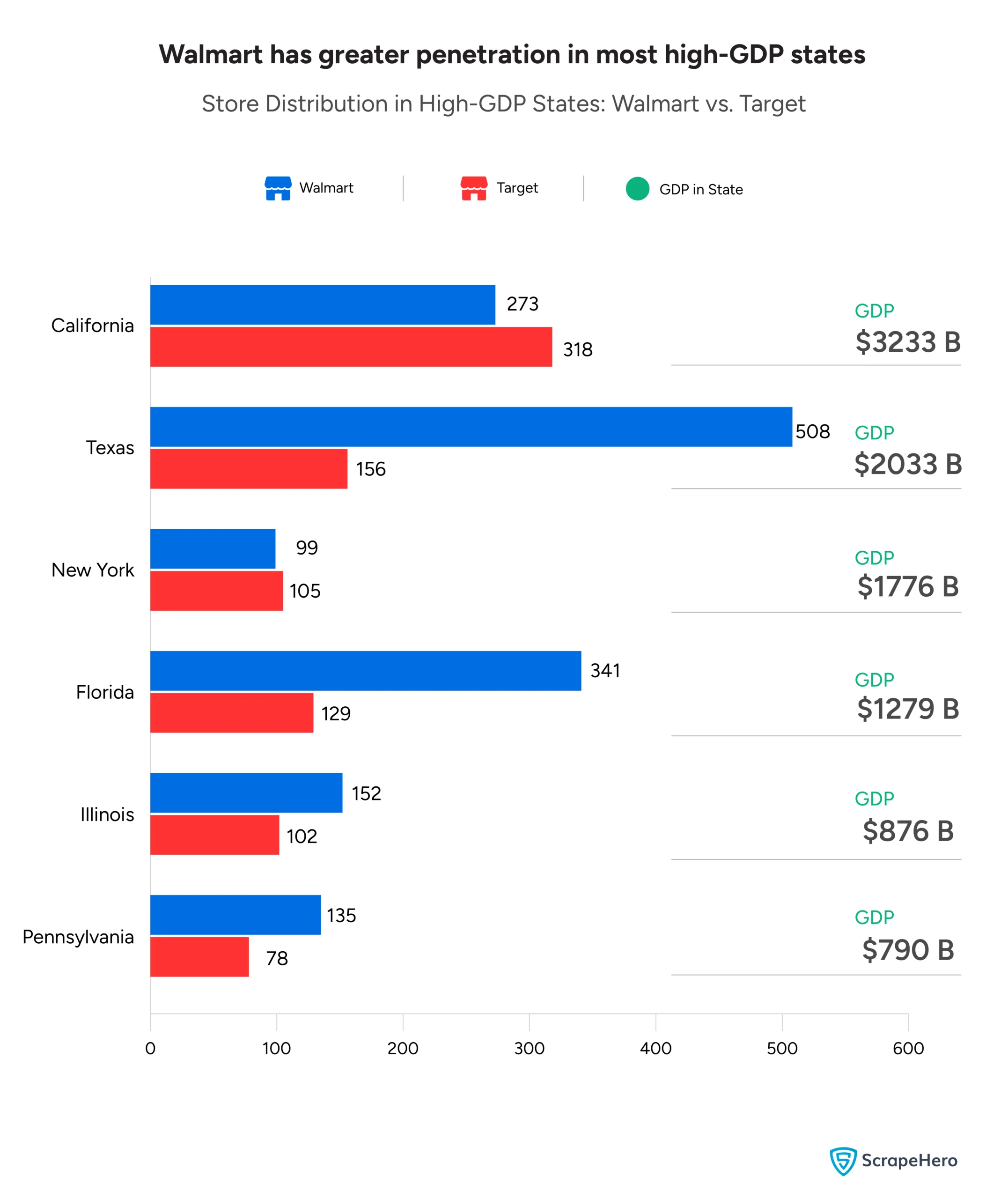

State GDP and Store Distribution: Walmart vs. Target

We analyzed how Walmart and Target had placed their stores in states with high GDP and those with low GDP. This was an attempt to find out if they followed any strategy regarding a state’s economic capacity.

How are Stores Distributed in States with High GDP?

There is a clear relationship between a state’s GDP and the number of Walmart and Target stores. Still, variations exist, indicating different market strategies or regional demands in some states.

Walmart has a significantly larger presence than Target in states like Texas, Florida, Illinois, Georgia, etc. For instance, Texas has 508 Walmart stores compared to only 156 Target stores.

Target has a closer gap with Walmart in states like California and New York. For example, in California, Walmart has 273 stores while Target has 318, which is actually higher than Walmart.

States with higher GDPs, such as California ($3,233 billion) and Texas ($2,033 billion), also tend to have a higher number of Walmart and Target stores.

Walmart seems to dominate in overall store count in most states, except California and New York, where Target has a slight edge.

This suggests Walmart has greater penetration in most high-GDP states, except in a few instances like California.

However, despite New York’s high GDP ($1,776 billion), Walmart and Target’s store counts are relatively lower compared to other states like Texas and Florida.

Read our Google Review Analysis of Walmart in Dallas to find out.

How are Stores Distributed in States with Low GDP?

Our analysis of the Walmart vs Target comparison shows that Walmart has a stronger market presence in states with lower GDP. In contrast, Target’s presence is limited and sporadic across these regions.

Walmart has a significantly larger store presence than Target in almost all low-GDP states.

For example, in West Virginia, Walmart has 39 stores compared to only 7 Target stores, and in Maine, Walmart has 22 stores compared to just 6 Target stores.

In several states, such as North Dakota, South Dakota, and Wyoming, Target has only 4 or 5 stores compared to Walmart’s 14-15 stores in those regions.

States with lower GDPs, like Vermont ($35 billion), Wyoming ($39 billion), and Alaska ($53 billion), also have fewer Walmart and Target stores. Vermont, for example, has only 6 Walmart stores and 1 Target store.

Thus, in these states with lower economic output, Walmart appears to be the dominant retailer.

Thus, we can conclude that Walmart dominates the market of both low and high-GDP states.

In states like Wyoming and Montana, which have low GDPs, Walmart maintains a solid presence, while Target is nearly absent. In contrast, in high-GDP states, Target competes more closely with Walmart.

Target’s store count is far higher in high-GDP states, suggesting the company focuses more on economically better regions.

Who Store Clusters More: Walmart or Target?

Both Walmart and Target exhibit significant tendencies to cluster their stores.

Cities With More Target Store Clusters

Our analysis reveals that Target heavily concentrates its stores in major metropolitan areas. This could be an attempt to cater to high population densities and urban shoppers.

Chicago has the highest concentration of Target stores within a 5 km radius, with 150 stores. New York City follows closely with 118 stores.

Cities like Cambridge, MA (13 stores), Minneapolis, MN (11 stores), and Long Island City, NY (10 stores) have fewer stores.

This could be because they have smaller geographic areas or lower population densities than cities like Chicago or Los Angeles.

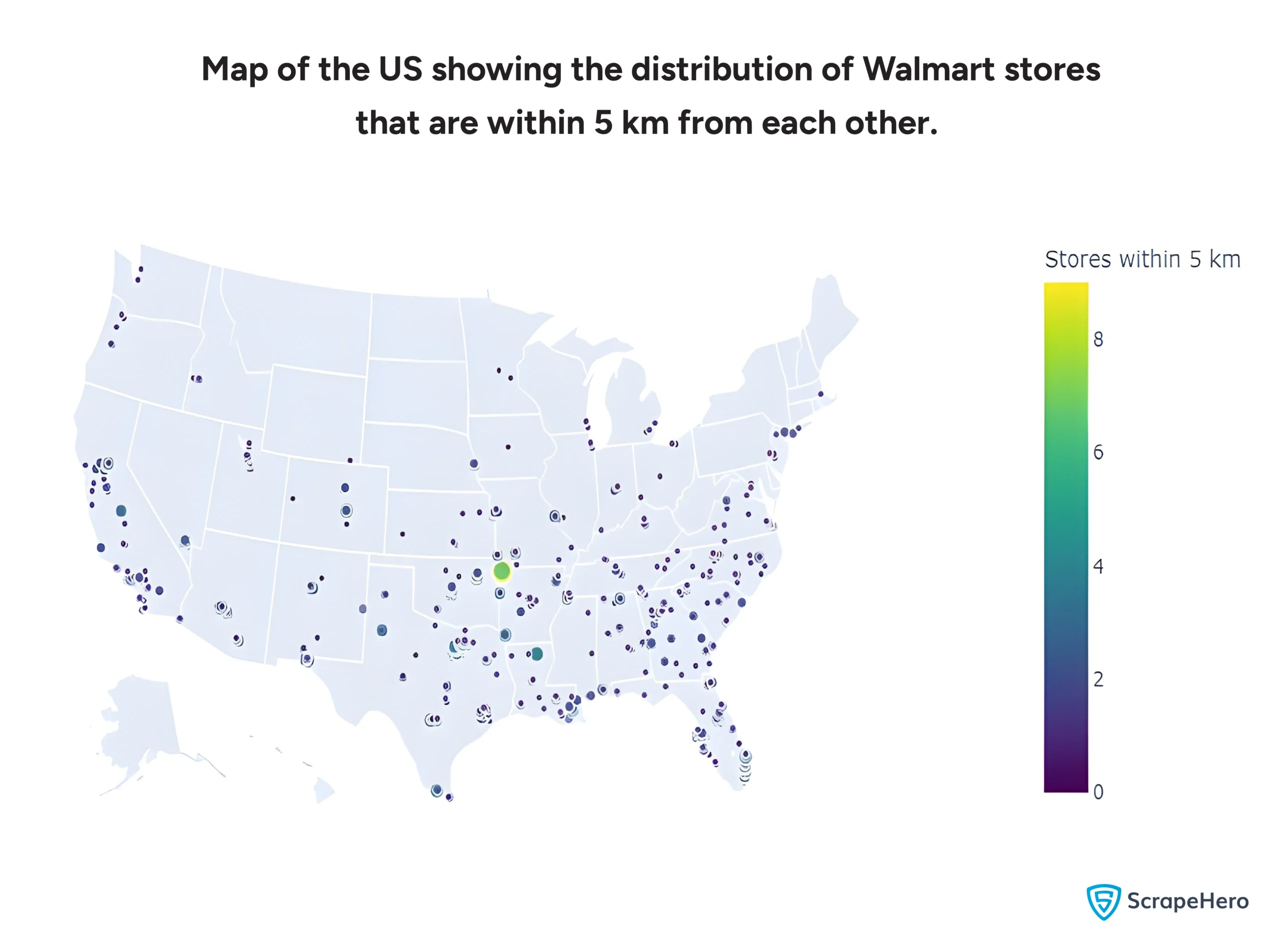

Cities With More Walmart Store Clusters

Bentonville, Arkansas, has the highest number of Walmart stores within a 5 km radius, with 73 stores. This is an interesting observation since Bentonville is Walmart’s headquarters.

Bakersfield, California, follows Bentonville far behind but still has 43 stores.

Unlike Target, where major metropolitan cities like Chicago and New York lead, Walmart’s stores are concentrated in many smaller or less populous cities, such as Dyersburg, TN, and Jefferson City.

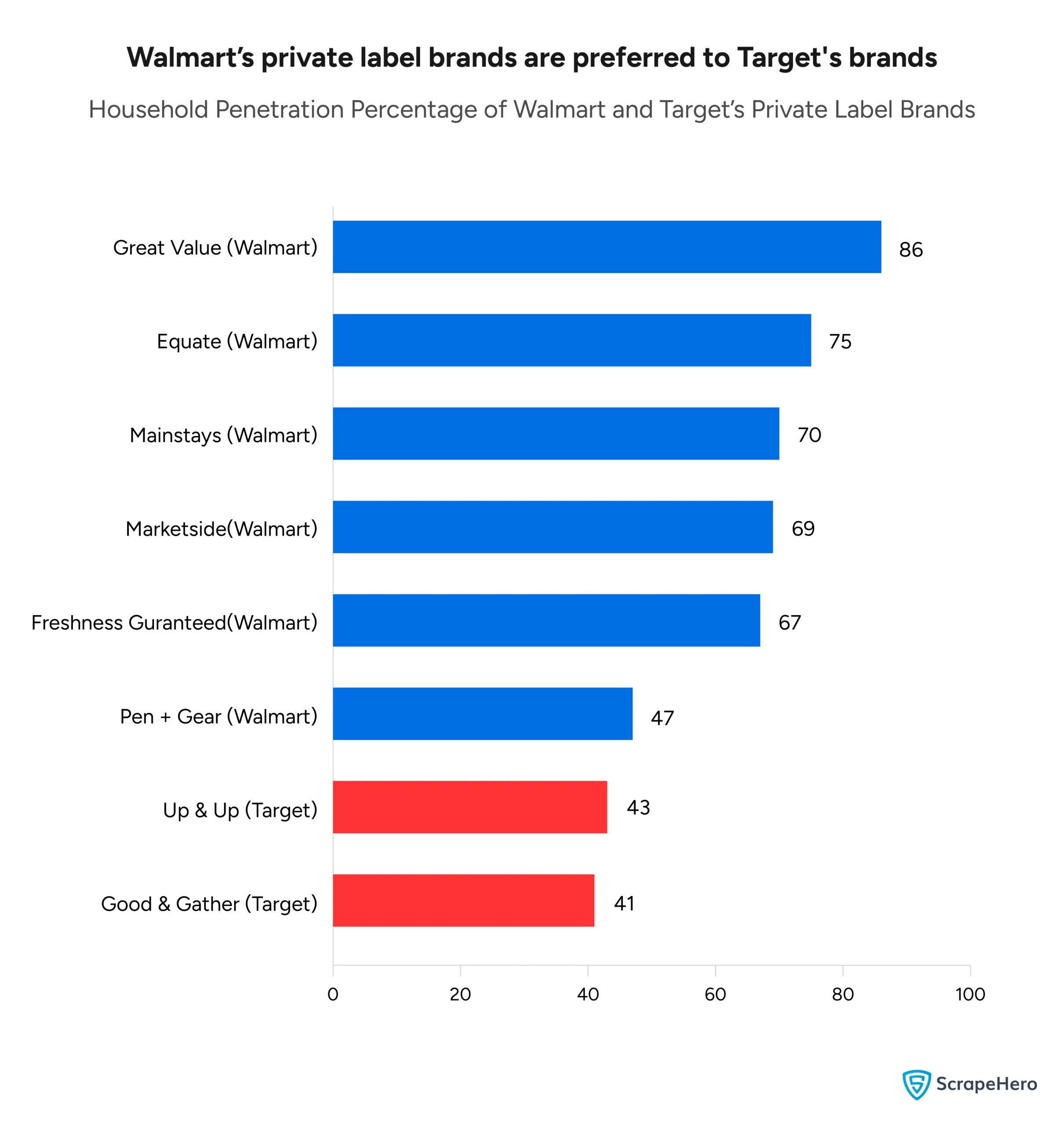

How Popular are the Private Label Brands of Walmart and Target

Private label brands are brands owned by a company but sold under different names. Both Walmart and Target have many such brands under them.

Let us look at the percentage of households that have bought store brands from Walmart and Target.

The above graph, drawn from Chain Store Age’s insights, clearly shows the popularity of Walmart’s private label brands.

Great Value, which is Walmart’s private label brand, has the highest household penetration at 86%, meaning it reaches 86% of households.

Only two of the top eight store brands are Target’s private label brands: Up & Up and Good & Gather.

It can thus be said that Walmart brands are more prevalent among people in the US.

Walmart vs. Target: How Do Their Revenues Compare?

With more stores and better presence across the US, Walmart definitely has the potential to generate higher sales volumes due to increased foot traffic and market penetration compared to Target.

According to Companies Market Cap, Walmart’s revenue is about six times higher than Target’s, reflecting Walmart’s dominant position in the US retail market.

Since we already know that Walmart has more than twice as many stores as Target in the US, it makes sense that Walmart generates substantially more revenue.

The larger number of stores provides more sales opportunities, contributing to its higher revenue.

Final Thoughts on the Walmart vs. Target Comparison

Our analysis shows that Walmart’s approach in the US is to establish a strong and consistent presence nationwide, which helps them attract a diverse range of customers.

In contrast, Target tends to focus on more affluent urban areas, which means it has fewer stores in regions with lower economic growth and is more concentrated in states where people have higher disposable incomes.

This strategy is also reflected in the revenue and popularity of their private label brands.

Having access to data like Points of Interest (POI) can be incredibly valuable for understanding market dynamics and keeping an eye on your competitors.

If you are in need of POI location data, consider getting it from ScrapeHero Data Store because,

- We monitor 3,000+ brands across 30+ industries globally for store openings, store closures, parking availability, in-store pickup options, nearest competitor stores, etc.

- You can download the data as you like or integrate your applications with our POI API to get the latest data.

- Our datasets are updated monthly.

- Our datasets undergo multiple rounds of automated and manual checks to ensure quality.

- Most of our datasets are priced lower than our competitors.

- We offer custom data enrichment services.

However, if you cannot find the store data you need on our Data Store or if you need custom data fields, data analysis, or historical data, it will be better to seek the help of a web scraping service like ScrapeHero. Connect with ScrapeHero web scraping service for a fully managed enterprise-grade service.