Fun Fact: The first Kroger store was opened in downtown Cincinnati in 1883 by Barney Kroger, an American businessman who invested his life savings of $372 to bring his vision to life.

Since then, the company has grown rapidly and is now one of the largest supermarket chains in the US, among others, like Walmart, Target, Whole Foods Market, and Costco.

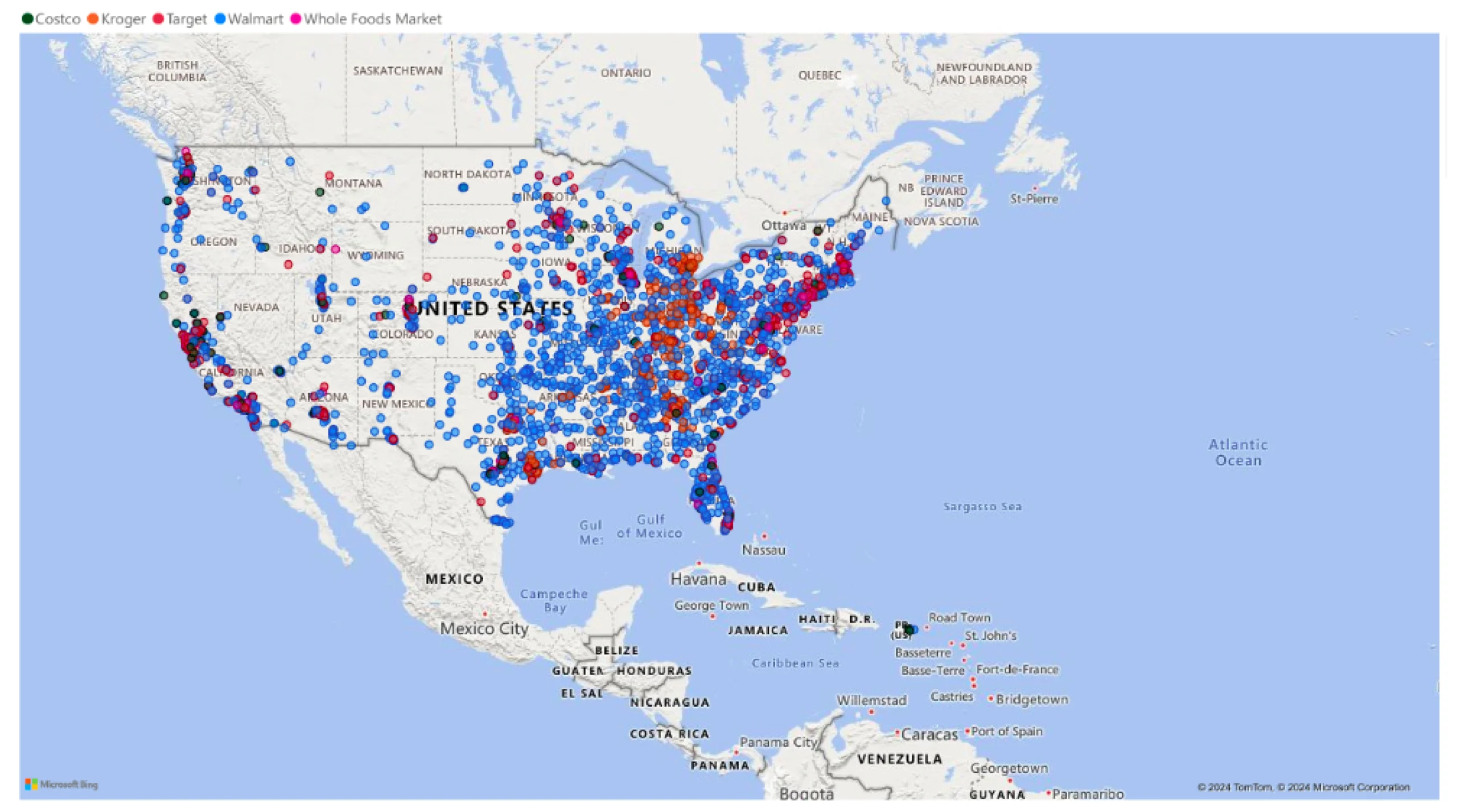

To understand the geographical distribution of Kroger vs. competitors mentioned above, we downloaded the location data of all these grocery retailers from the ScrapeHero Data Store and conducted an analysis.

Our aim is to illustrate their distribution across states and cities and how they place themselves near each other.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

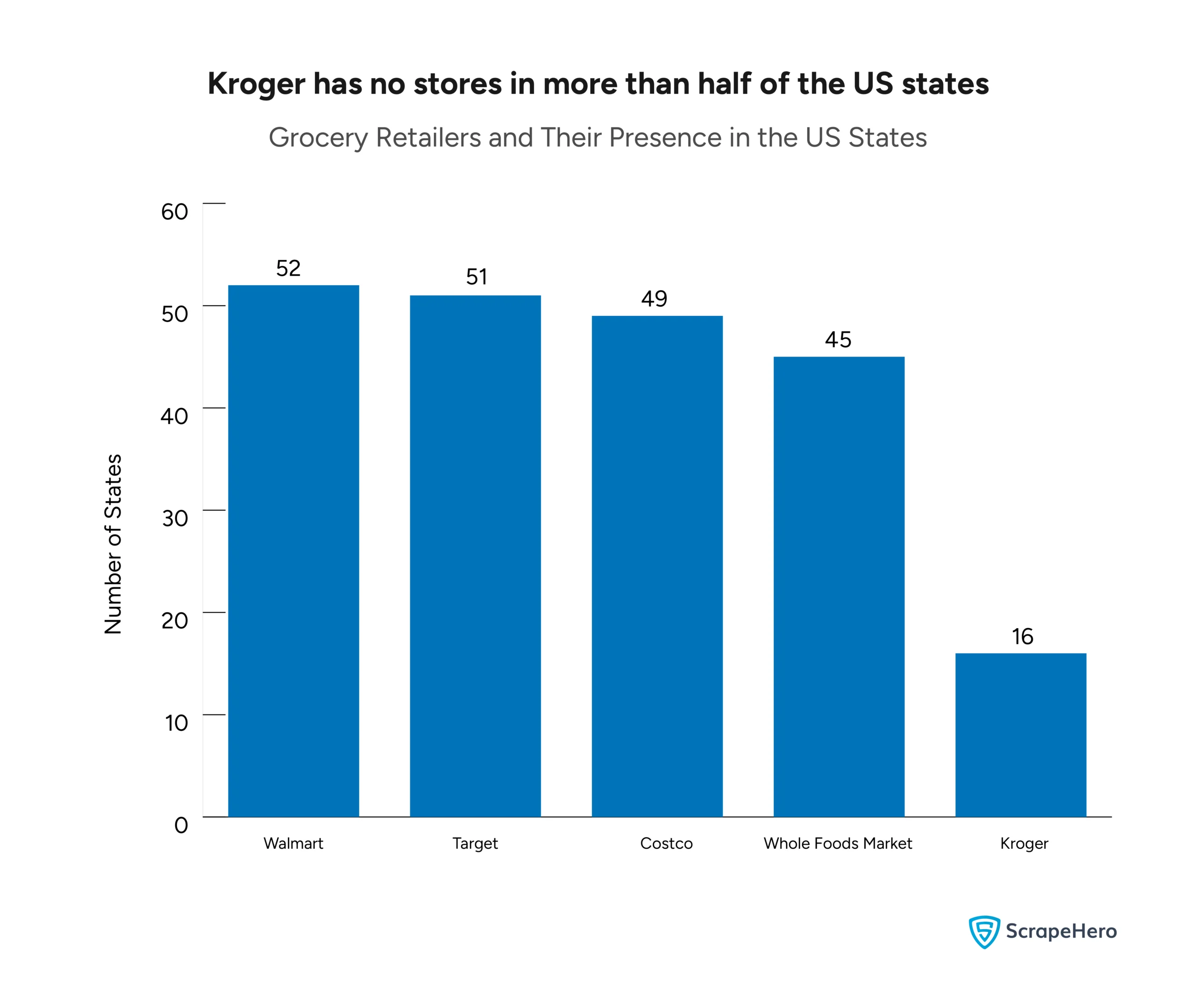

Kroger vs. Competitors in the US States

Unlike its competitors, who have a presence in more than half of the US states, Kroger has stores only in 16 states.

Walmart leads the pack with a presence in 52 states.

Target follows closely with stores in 51 states and Costco at 49.

Whole Foods Market is present in 45 states.

Download the complete dataset of Kroger and Competitors for only $397!

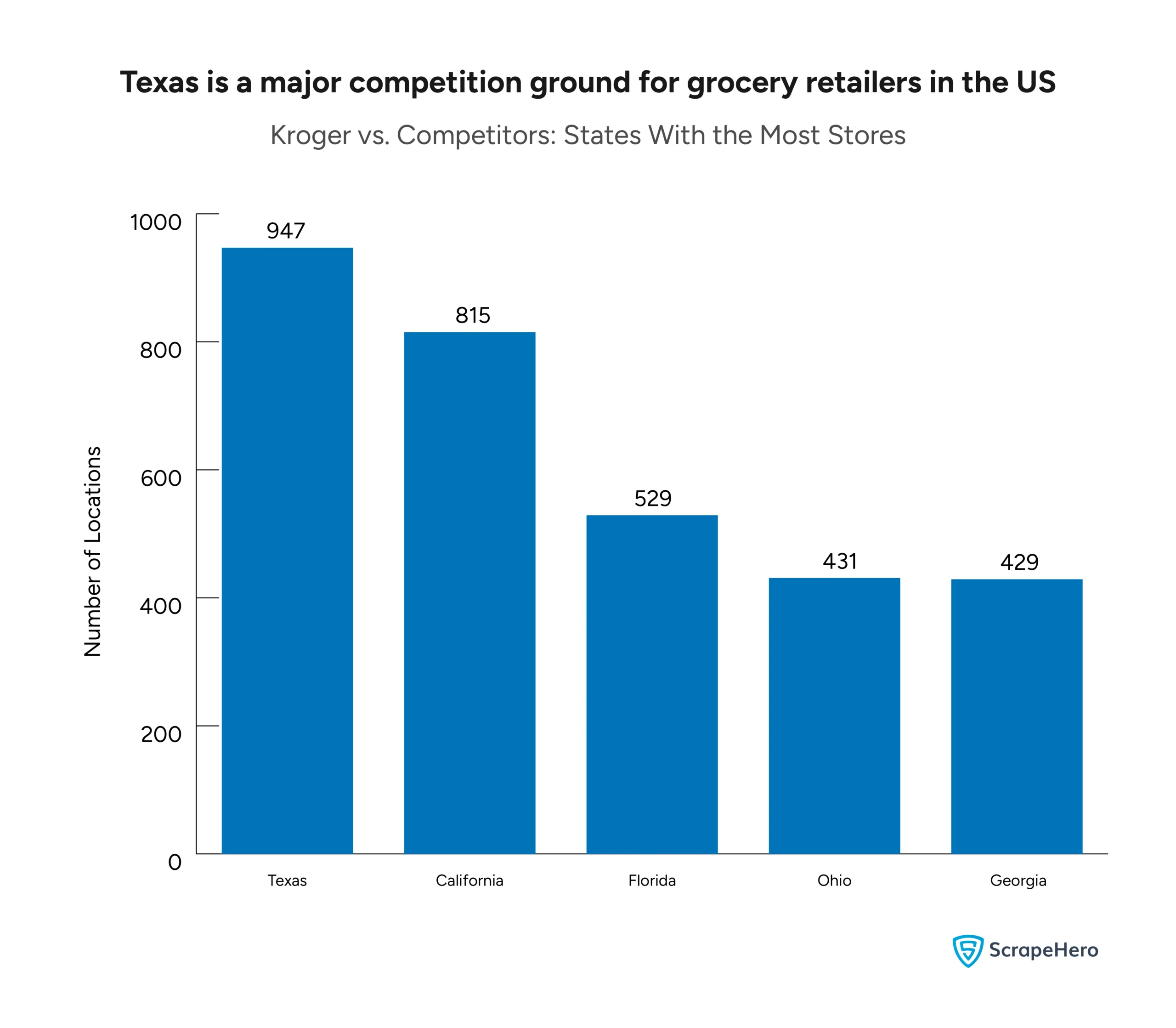

States With the Most Number of Stores

Below is a graph that lists the top 5 states with the most Kroger, Walmart, Target, Costco, and Whole Foods stores in the US.

Texas leads with 947 locations, followed by California with 815.

Florida ranks third with 529 locations, while Ohio and Georgia follow with 431 and 429 locations, respectively.

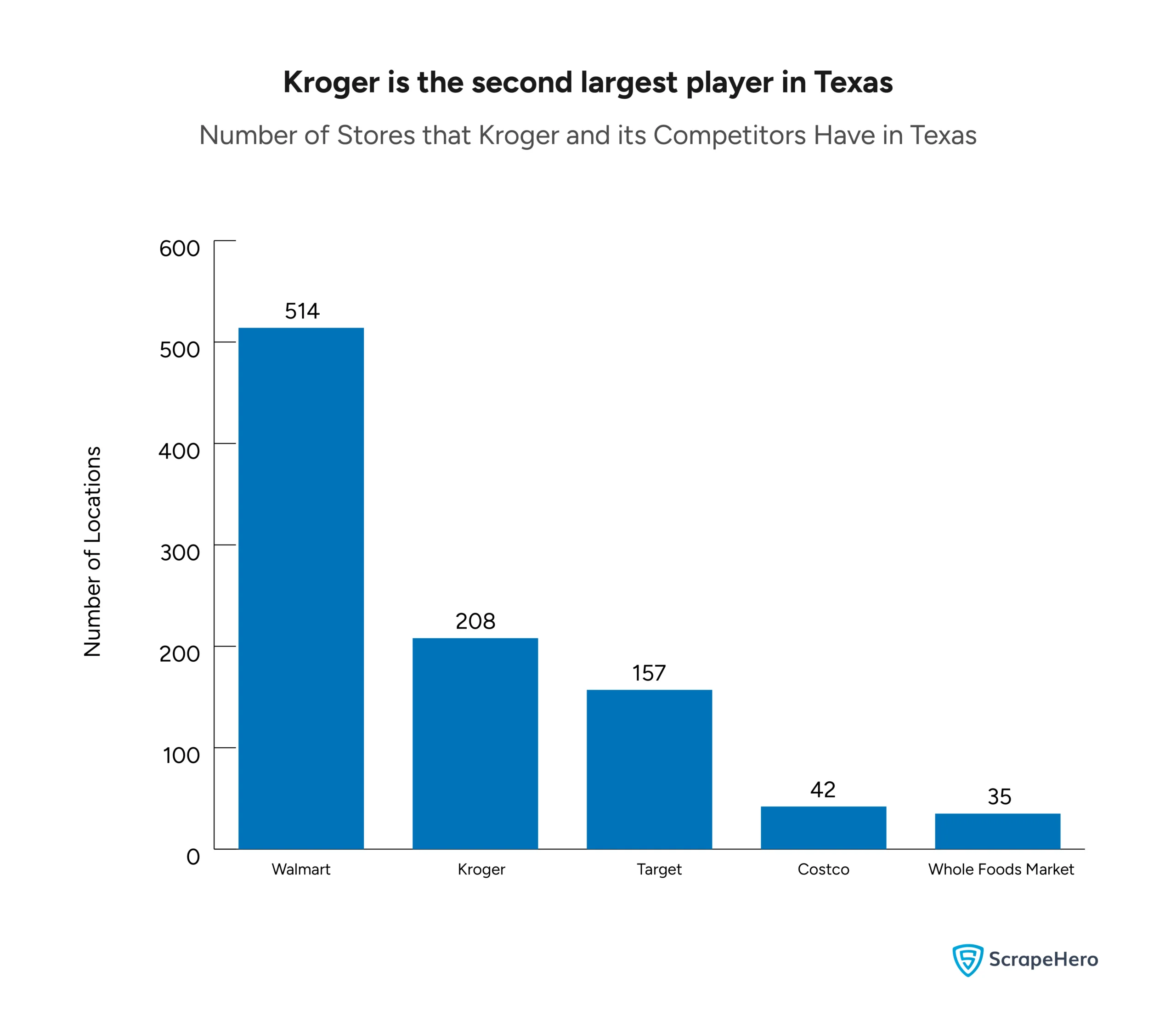

Distribution of Kroger vs. Competitors in Texas

Since Texas has the largest number of stores of grocery retailers in question combined, it makes sense to see how they have expanded in the state.

Walmart dominates with 514 stores, far surpassing the other retailers.

Kroger is the second-largest player in Texas, with 208 locations.

Target follows with 157 stores.

Costco and Whole Foods Market trail with 42 and 35 stores, respectively.

While Kroger operates more stores than Target, Costco, and Whole Foods in Texas, it is still less competitive in terms of numbers against Walmart, which has over double Kroger’s presence in the state.

It’s interesting to note that when all the Kroger stores in the US are considered, Texas still comes second. Kroger has the most number of stores in California.

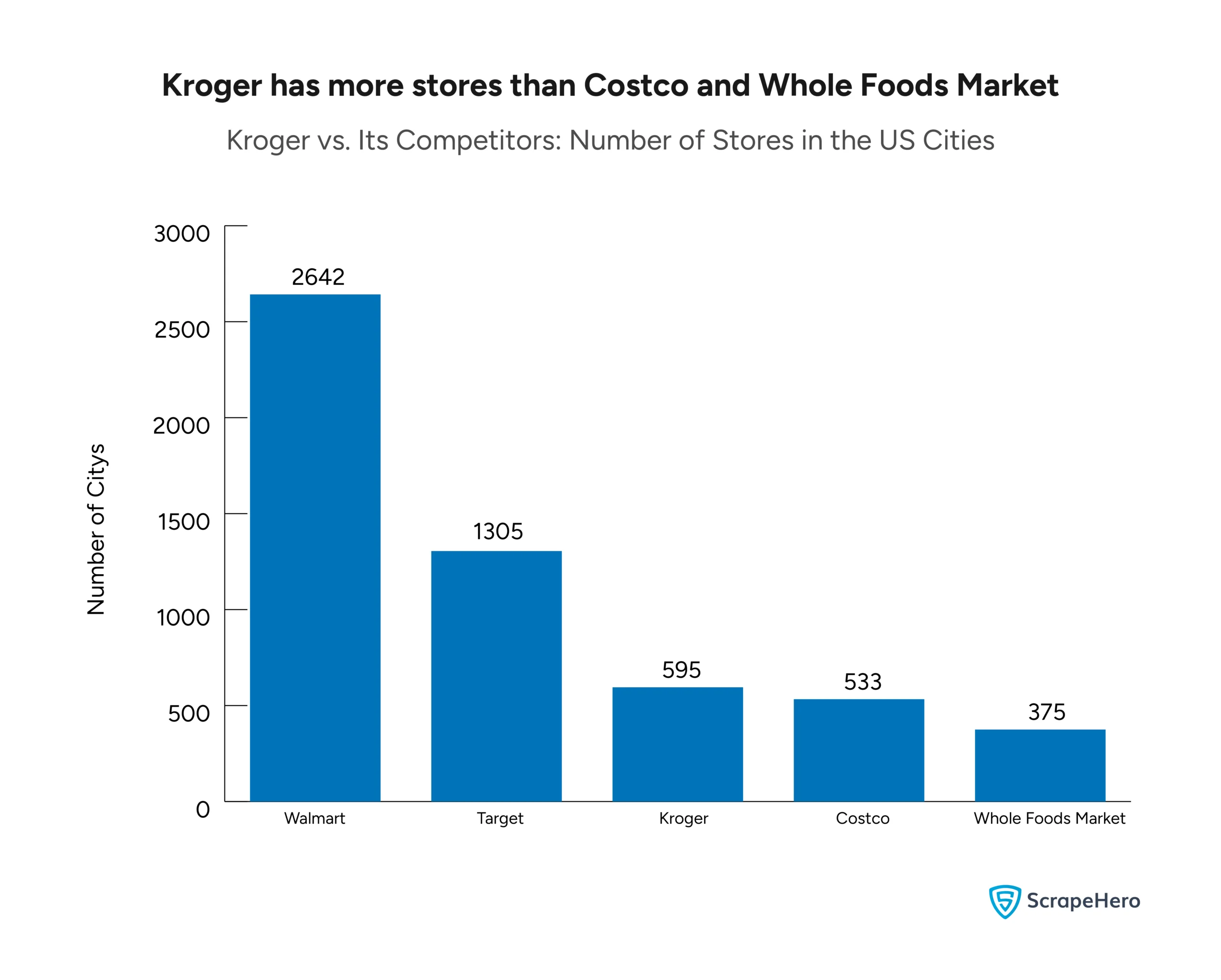

Kroger vs. Competitors in the US Cities

The below graph showcases the presence of five major retailers—Walmart, Target, Kroger, Costco, and Whole Foods Market—by the number of cities in which they operate across the US.

Kroger has a presence in 595 cities, making it a strong competitor in the grocery market.

While Walmart dominates with 2,642 cities and Target has 1,305 cities, Kroger surpasses Costco and Whole Foods Market.

This highlights Kroger’s significant footprint despite the dominance of larger competitors.

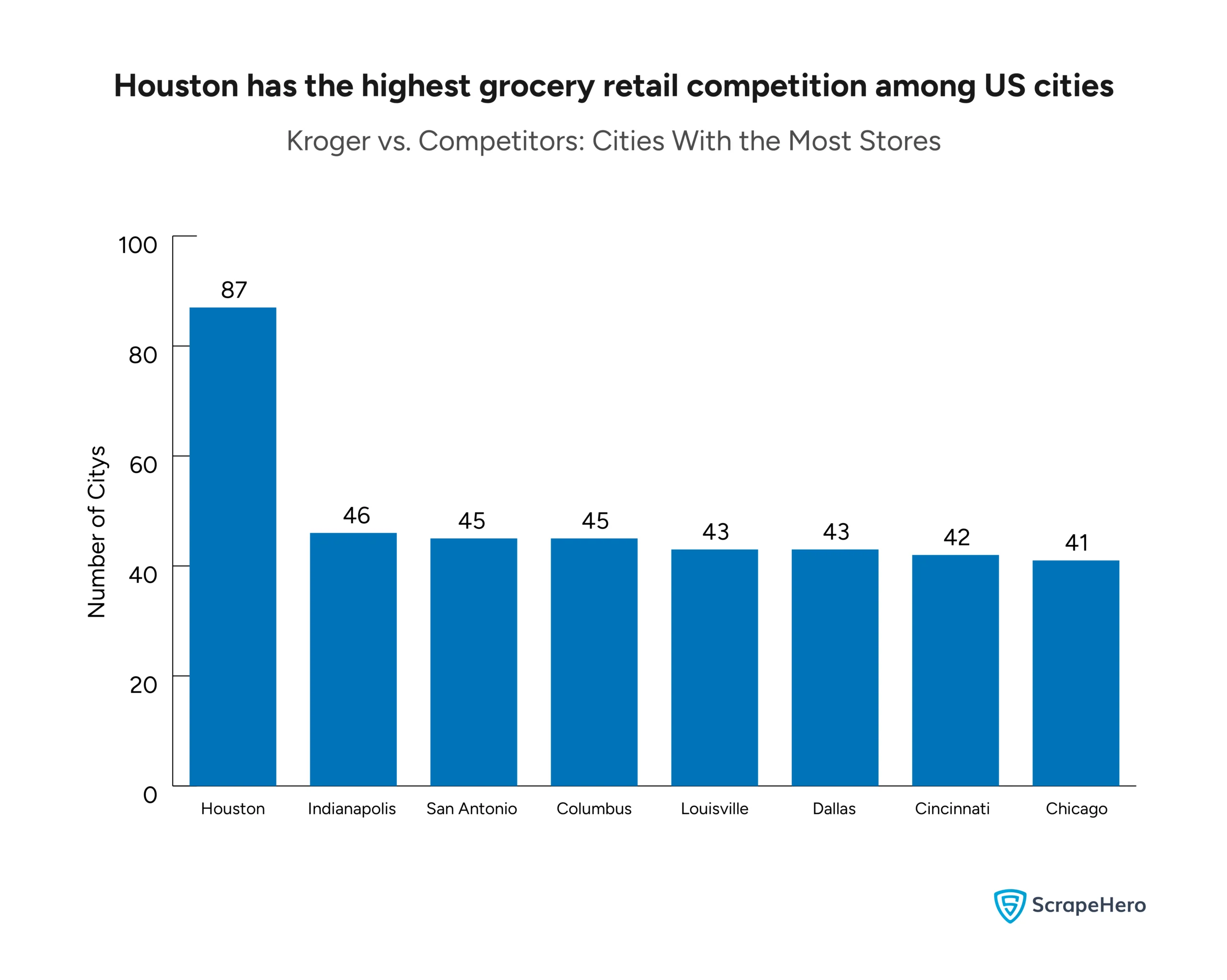

Cities With the Most Number of Stores

Among the cities with the highest combined locations of Walmart, Kroger, Target, Whole Foods, and Costco, Houston comes first with 87 locations.

Indianapolis, San Antonio, and Columbus each have 45-46 locations.

Louisville, Dallas, Cincinnati, and Chicago follow closely, with 41-43 locations each.

Kroger vs. Competitors: Proximity to Rivals

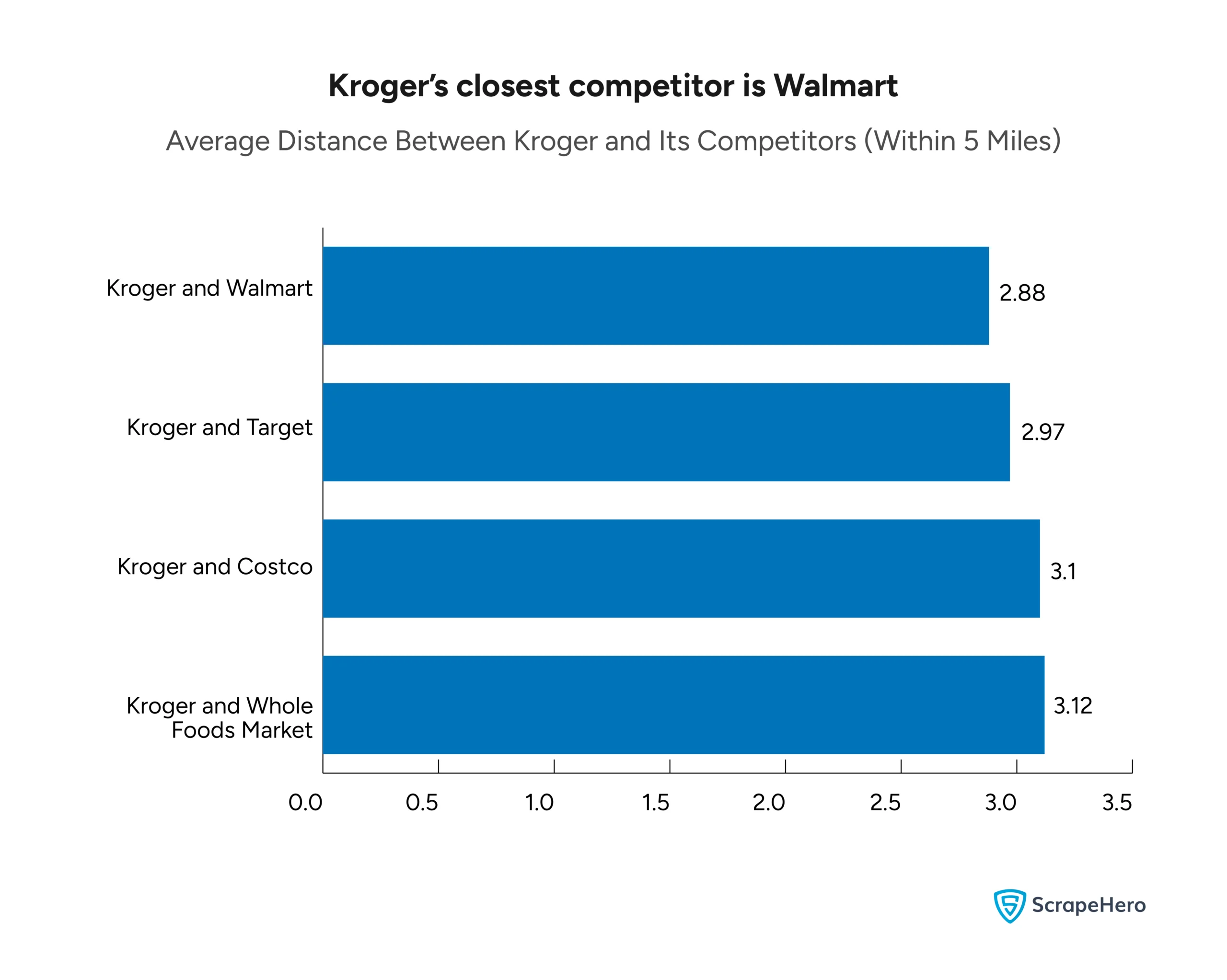

We analyzed the average distance (in miles) between Kroger and its competitors—Walmart, Target, Costco, and Whole Foods Market—when they are located within a 5-mile radius.

And here’s what can be said about Kroger’s positioning relative to its competitors.

The closest competitor to Kroger is Walmart, with an average distance of 2.88 miles.

Target follows closely at 2.97 miles.

Costco and Whole Foods Market have slightly larger average distances, at 3.1 and 3.12 miles, respectively.

In an analysis of Kroger versus its competitors, this data emphasizes the intensity of competition Kroger faces in close proximity to its stores.

Do you think these retail competitors randomly opened their stores without considering their proximity to one another?

Absolutely not.

The process of opening a store is meticulous and requires extensive research.

Google Maps can be an invaluable tool in this phase of store expansion.

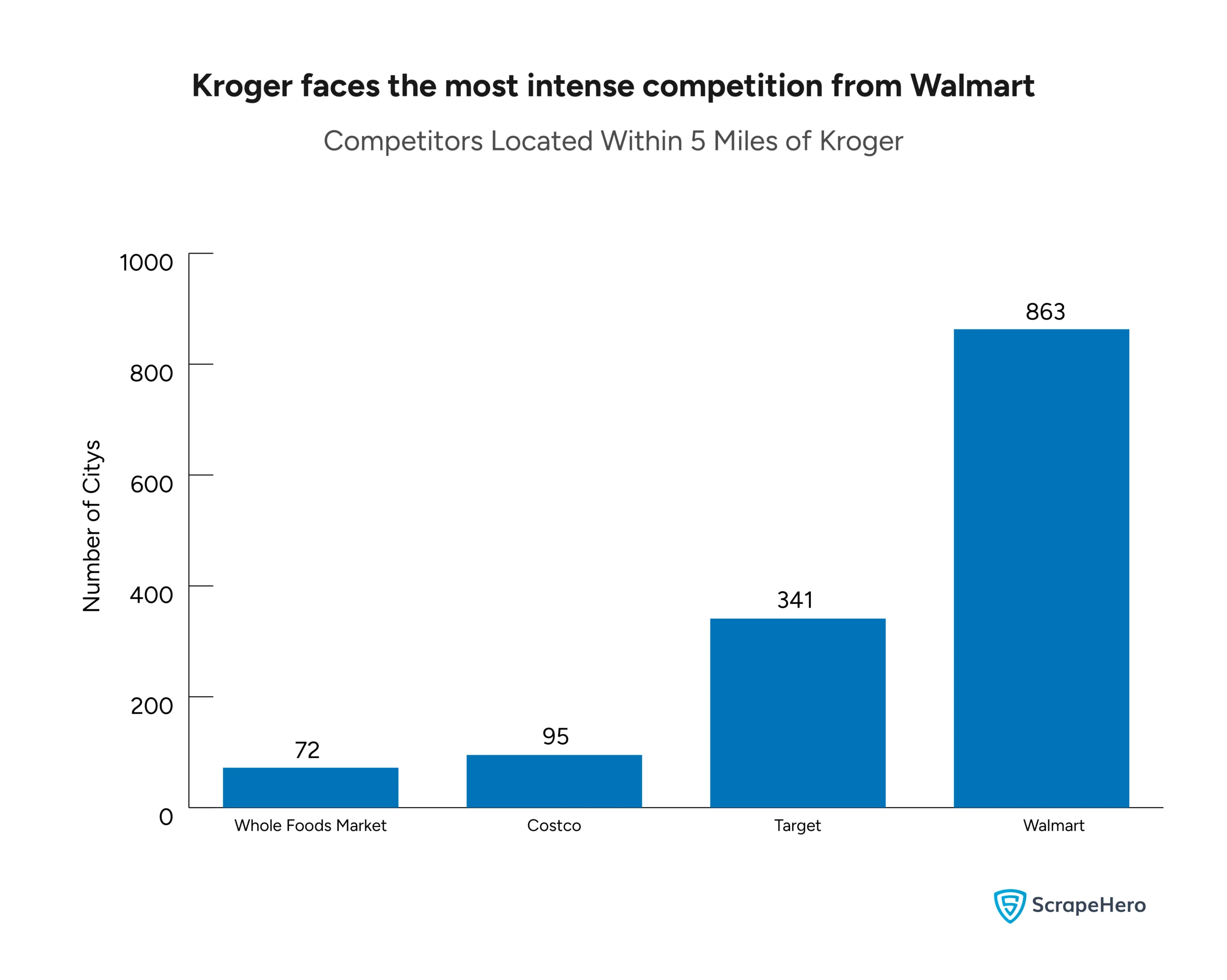

Number of Competitor Stores in Close Proximity to Kroger

Within a 5-mile radius of Kroger stores, Walmart emerges as the strongest competitor, with 863 distinct locations nearby, indicating a significant overlap in market presence.

Target follows with 341 stores, making it a notable competitor but less concentrated than Walmart.

Costco and Whole Foods Market have smaller footprints, with 95 and 72 stores, respectively.

This data highlights that Kroger faces the most intense competition from Walmart and Target.

What Can Be Said About the Kroger vs. Competitor Analysis?

This blog post analyzes the geographical distribution of Kroger and its main competitors (Walmart, Target, Costco, and Whole Foods Market) across the US.

Kroger is a major grocery retailer in the US, but it faces stiff competition from larger players like Walmart and Target.

Kroger has stores in 16 states, while its competitors have a presence in more than half of the US states.

Although Kroger has fewer stores overall, it is the second-largest player in Texas.

Kroger also has a strong presence in cities, with more stores than Costco and Whole Foods Market.

The analysis shows that Kroger’s closest competitor is Walmart, with an average distance of 2.88 miles between stores located within a 5-mile radius.

Walmart also has the most stores located within 5 miles of Kroger stores, indicating a significant overlap in market presence.

Interested in a Similar Analysis?

You probably understand how crucial it is to have access to data relevant to your field of interest by now.

Data enables you to analyze and grasp trends and patterns effectively.

Why worry about expensive infrastructure, resource allocation and complex websites when ScrapeHero can scrape for you at a fraction of the cost?Go the hassle-free route with ScrapeHero

Scrapehero web scraping service can provide a comprehensive solution for businesses looking to extract valuable data from the web without the need for technical expertise or infrastructure.

We eliminate the need for clients to invest in software, hardware, proxies, or scraping tools.