About the Report: This report analyzes the geographic distribution of ten major jewelry brands across the US to identify key market trends and location strategies. The analysis utilizes data on store counts at the national, state, and city levels, as well as the average proximity of Claire’s stores to other jewelry retailers.

Jewelry Brands in the US in Discussion: Claire’s, Pandora, Swarovski, Kate Spade, Tiffany & Co, Chopard, David Yurman, Hermès, Van Cleef & Arpels, and Harry Winston

Source of Data: POI data of 3,779 store locations downloaded from ScrapeHero Data Store.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

Overview of the US Jewelry Market

According to Classy Women Collection, the US jewelry market, valued at $69.15 billion, is the second-largest globally and accounts for 20% of the total market.

It spans from affordable brands like Claire’s and Kate Spade to mid-tier names such as Pandora, Swarovski, and David Yurman and luxury leaders like Tiffany & Co., Chopard, Hermès, Van Cleef & Arpels, and Harry Winston.

Where are the Jewelry Brands in the US Concentrated?

Knowing where jewelry brands are concentrated helps businesses understand market demand, competition, and consumer trends.

This section explores the major clusters of jewelry brands in the US.

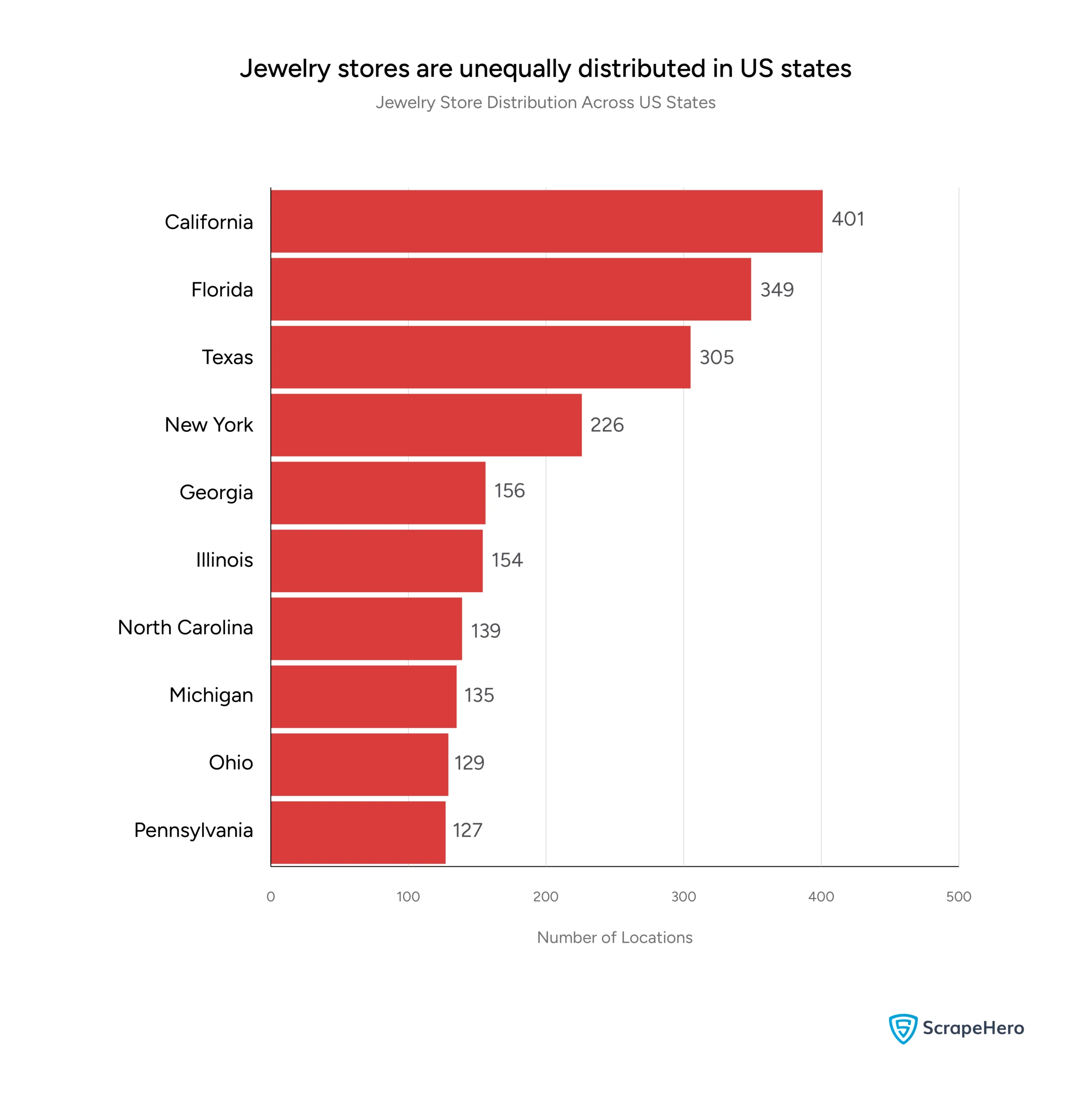

Are Brands Equally Distributed Across the US States?

To answer simply, no!

The distribution of jewelry store locations in the US is far from equal, as shown in the graph.

California (401), Florida (349), and Texas (305) lead the market with the highest number of jewelry stores.

New York (226) also plays a key role, though it has fewer stores than the top three states.

States like Georgia (156), Illinois (154), and North Carolina (139) have a moderate presence.

Meanwhile, Michigan (135), Ohio (129), and Pennsylvania (127) round out the top ten.

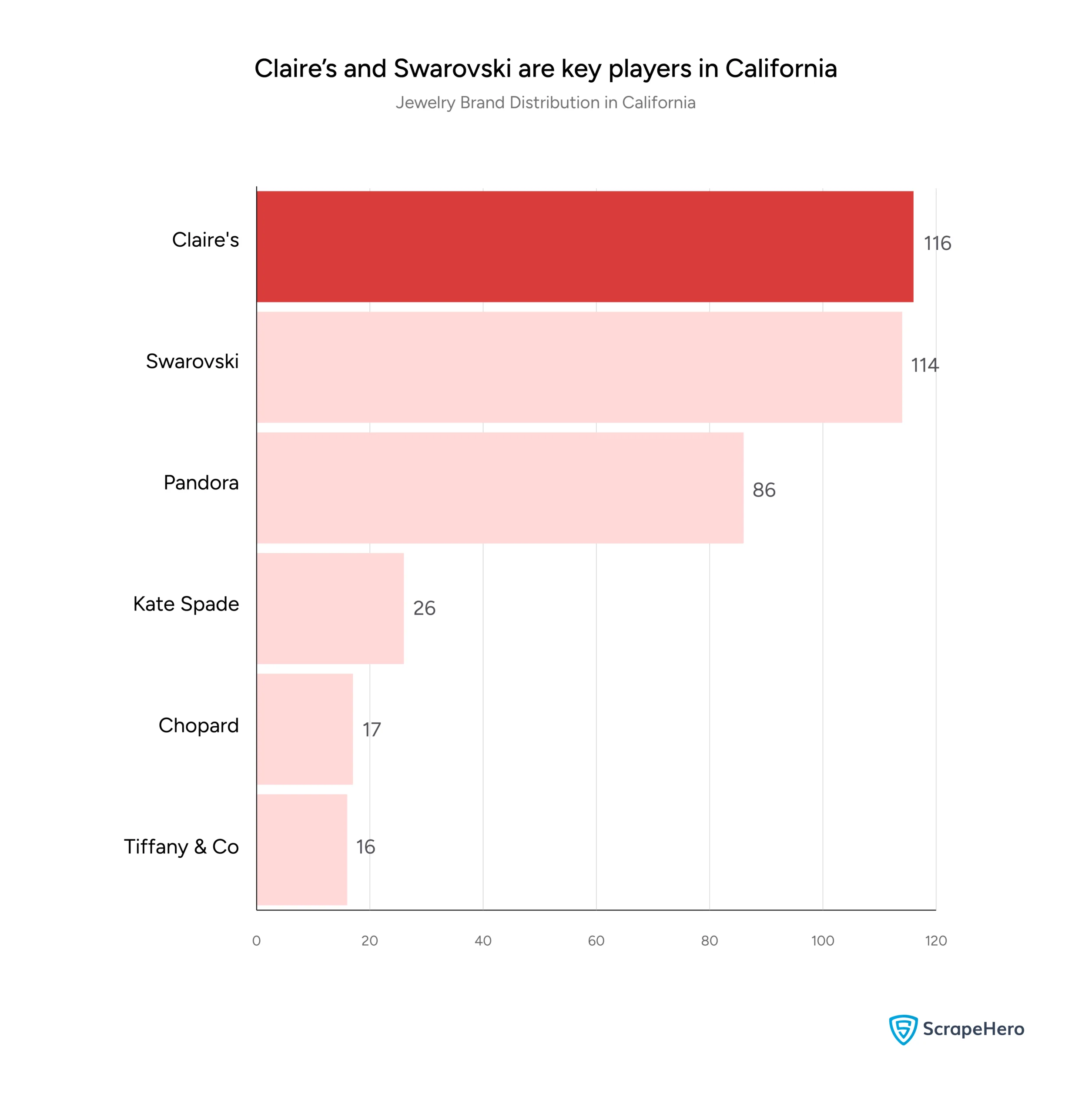

What Does California’s Jewelry Landscape Look Like? <h4>

California, the state with the highest number of jewelry stores in the US, hosts a diverse mix of brands, from affordable fashion jewelry to high-end luxury.

Claire’s (116) and Swarovski (114) dominate. Pandora (86) follows closely.

Luxury brands like Kate Spade (26), Chopard (17), and Tiffany & Co. (16) have fewer locations.

This distribution indicates that California’s jewelry market is driven by mass-market accessibility, with a smaller but significant presence of luxury brands catering to affluent buyers.

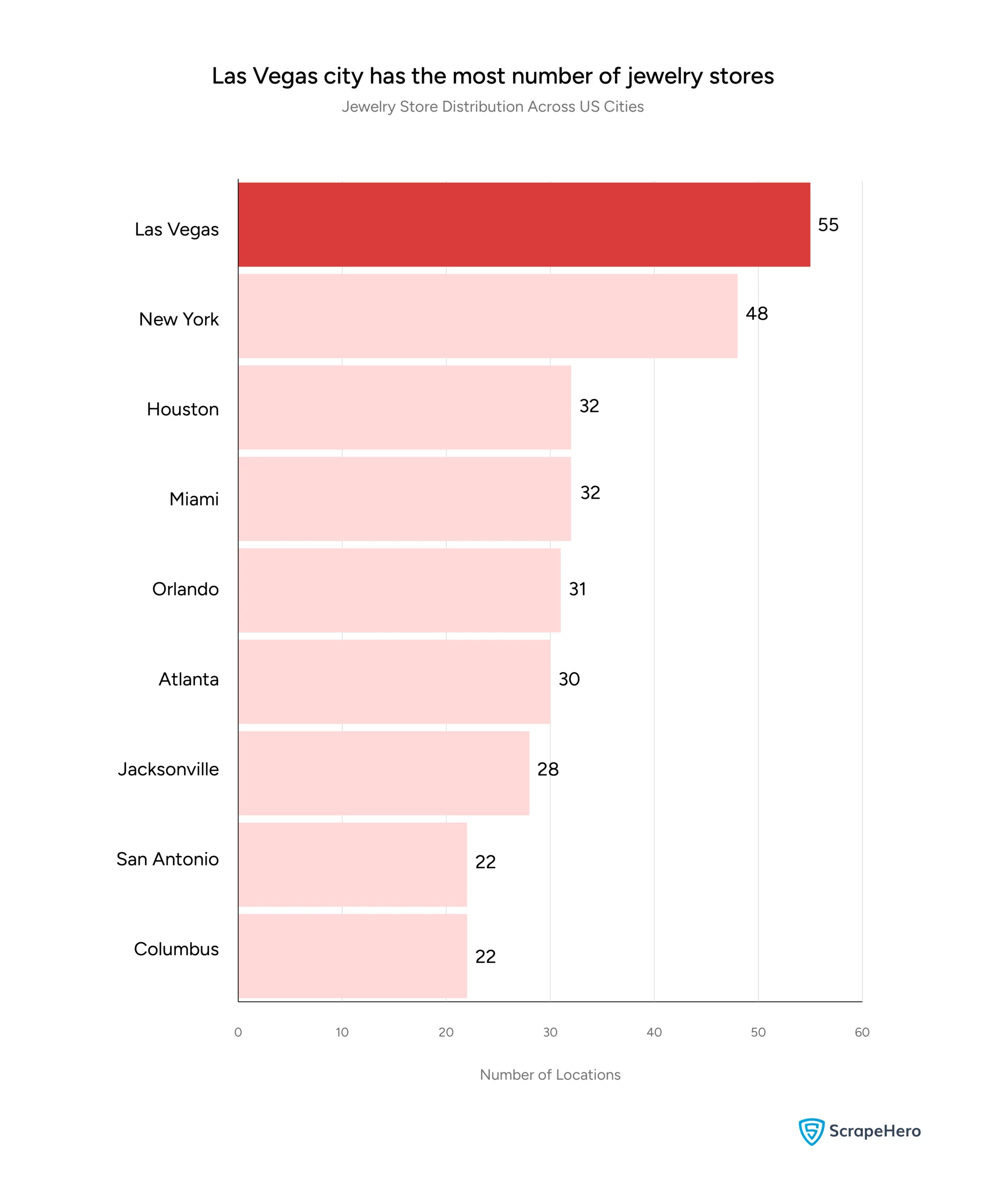

How are Jewelry Brands in the US Spread Across Cities?

The distribution of jewelry stores across US cities is uneven.

Las Vegas (55) leads the country. New York (48) follows closely.

Other major cities such as Houston (32), Miami (32), Orlando (31), and Atlanta (30) show a strong jewelry store presence.

Jacksonville (28), San Antonio (22), and Columbus (22) round out the list.

This insight can be helpful for brands looking to expand in assessing where competition is high and where untapped opportunities exist.

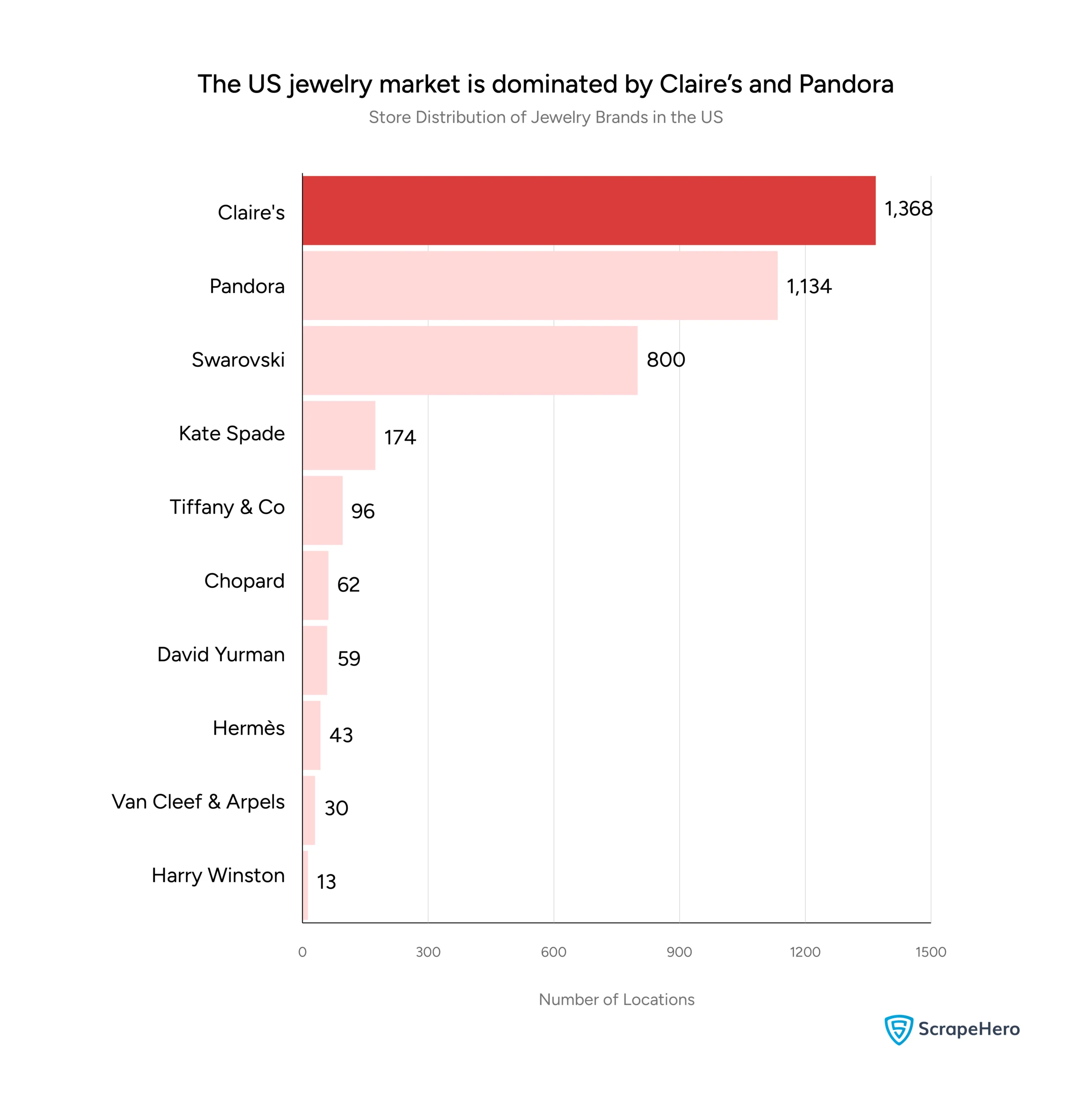

Which Brands Dominate America’s Jewelry Market?

The US jewelry market is dominated by Claire’s (1,368), Pandora (1,134), and Swarovski (800), having the highest number of store locations.

Among premium and luxury brands, Kate Spade (174) and Tiffany & Co. (96) have a more moderate presence.

High-end brands like Chopard (62), David Yurman (59), Hermès (43), Van Cleef & Arpels (30), and Harry Winston (13) maintain a smaller footprint.

You can instantly download the complete list of all Claire’s, Pandora, and Swarovski store locations here.

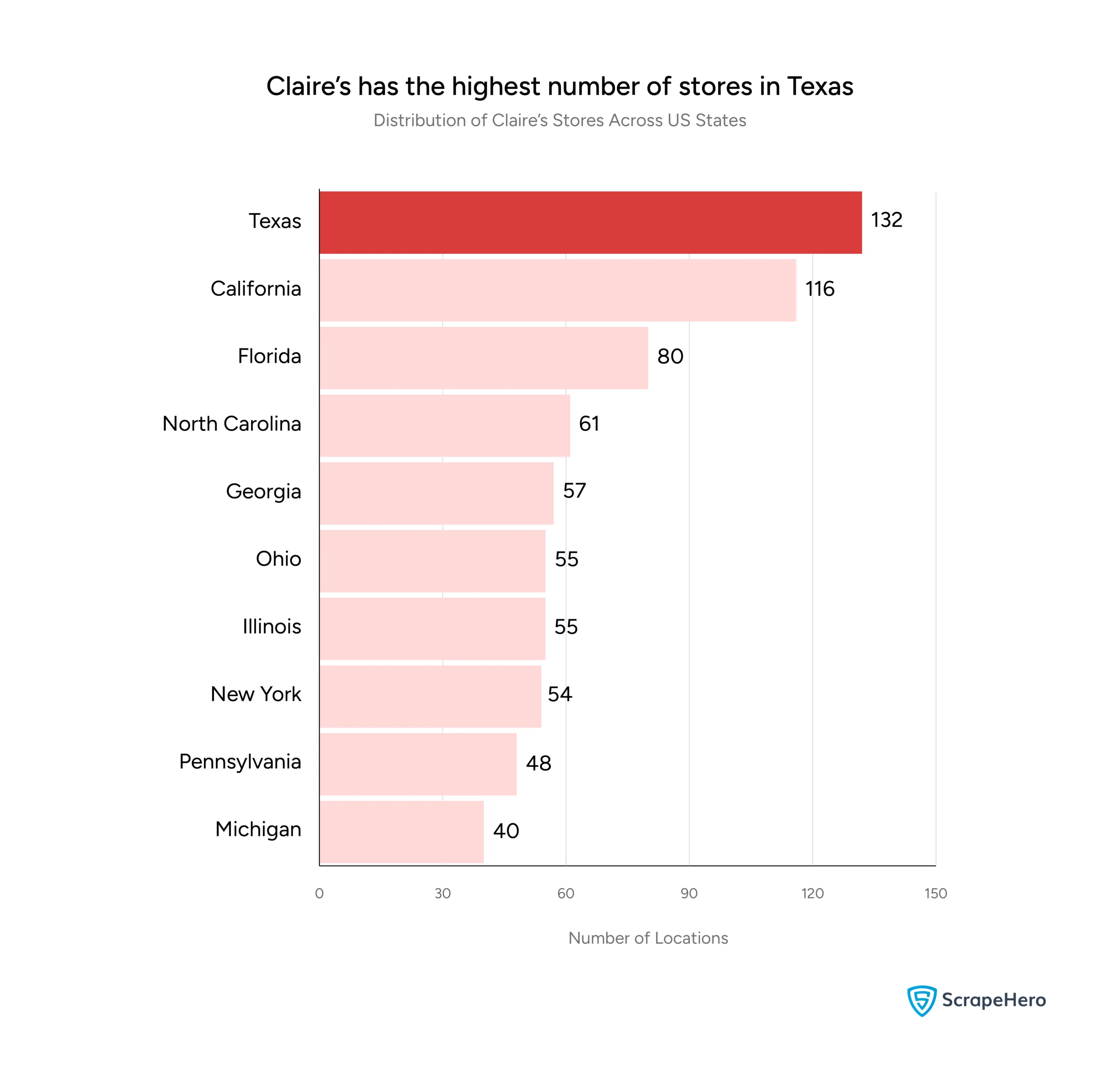

In Which States Has Claire’s Most Expanded?

Claire’s, a dominant player in the affordable jewelry and accessories market, has its highest number of store locations in Texas (132), California (116), and Florida (80).

The brand also has a significant presence in North Carolina (61), Georgia (57), Ohio (55), Illinois (55), and New York (54).

Pennsylvania (48) and Michigan (40) round out the top states.

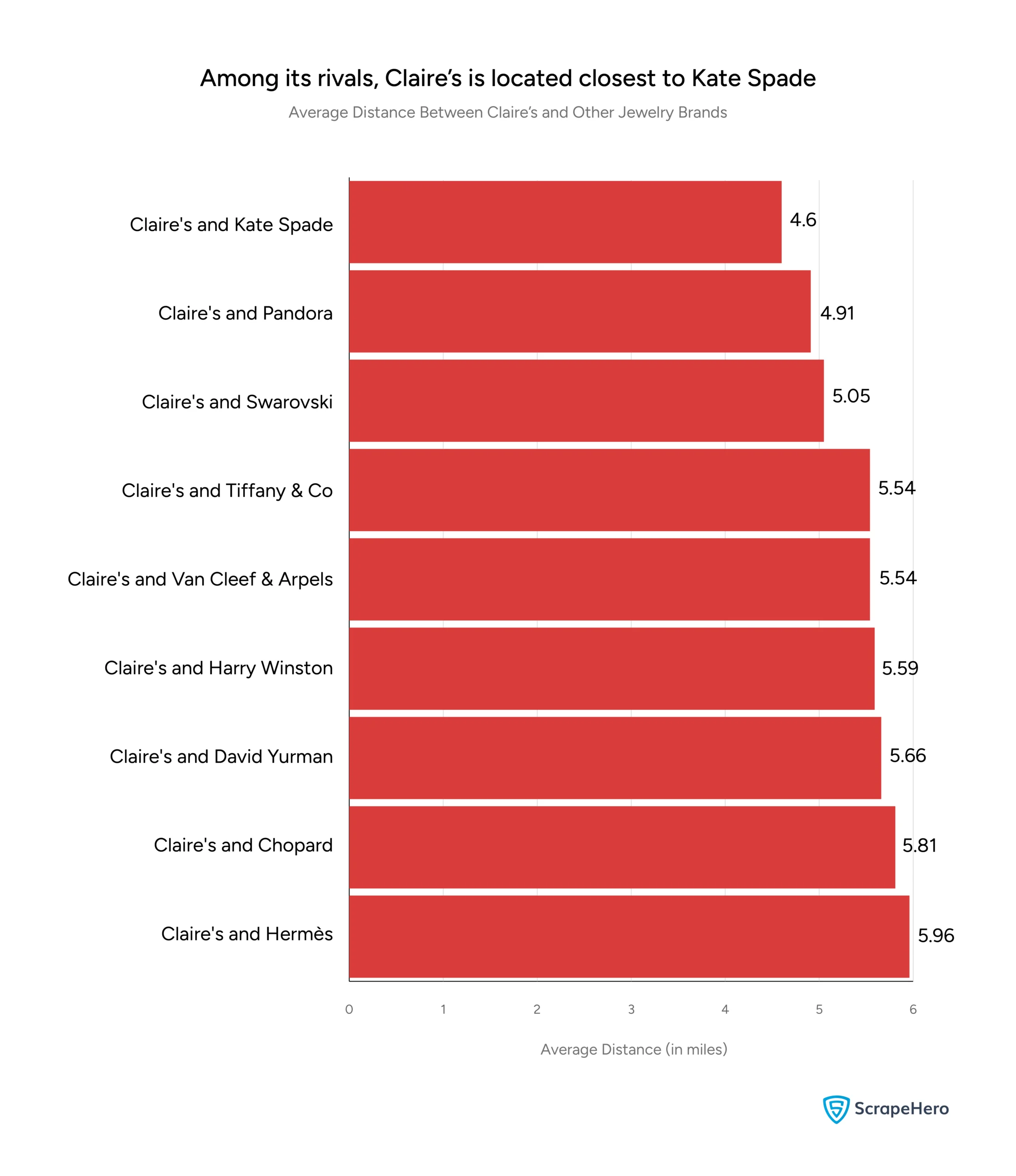

How Close is Claire’s To Its Competitors?

Claire’s tends to be located relatively close to other jewelry brands, particularly those in the affordable and mid-tier market segments.

The graph shows that Claire’s is closest to Kate Spade (4.6 miles on average), Pandora (4.91 miles), and Swarovski (5.05 miles), indicating that these brands often share retail spaces.

Want the complete list of all Kate Spade store locations in the US to compare with Claire’s?

Luxury brands like Tiffany & Co. (5.54 miles), Van Cleef & Arpels (5.54 miles), and Harry Winston (5.59 miles) are slightly farther away.

David Yurman (5.66 miles), Chopard (5.81 miles), and Hermès (5.96 miles) are even more distant.

Understanding these location patterns is a critical factor for business growth.

Brands expanding into new markets rely on data-driven insights to identify the best locations and assess competition.

One effective way to gather such insights is by scraping Google Maps for store locations and competitor analysis.

What Do We Now Know About Jewelry Brands in the US?

In conclusion, our analysis reveals significant insights into the geographic distribution of major jewelry brands across the US.

We’ve seen that the US jewelry market, a substantial $69.15 billion industry, exhibits an uneven distribution of stores across states and cities.

California, Florida, and Texas stand out with the highest number of jewelry store locations, while Las Vegas and New York City lead in terms of city concentration.

Furthermore, the market is dominated by brands like Claire’s, Pandora, and Swarovski in terms of sheer number of locations.

Even within these trends, nuanced details emerge, such as Claire’s having the most stores in Texas and being located closest to brands like Kate Spade, Pandora, and Swarovski on average.

Understanding these market dynamics, from state-level saturation to competitor proximity, is paramount for businesses aiming to thrive in the US jewelry sector.

While ScrapeHero Data Store has POI datasets of thousands of brands worldwide available for instant download, partnering with ScrapeHero’s web scraping service is the smarter choice if you require custom data extraction, complex web navigation, or simply want to save time.

We handle everything—data collection, accuracy, and delivery—so you don’t need software, hardware, or scraping expertise. Instead, you can focus on using data for your business, not extracting it.

Connect with ScrapeHero today.