The product counts listed in this article include products made available by Amazon’s private labels for purchase by public on Amazon.com.

Amazon is many things – an eCommerce innovator, tech giant, and fashion underdog that is slowly making its way up to the top. With Amazon Essentials and AmazonBasics, the company is really setting the tone for online fashion and experimenting between online and offline sales.

Since the launch of Amazon’s first private brand AmazonBasics, the company has been slowly starting its own labels across different categories. This article talks about these products, their price, and rating.

Amazon Private Labels

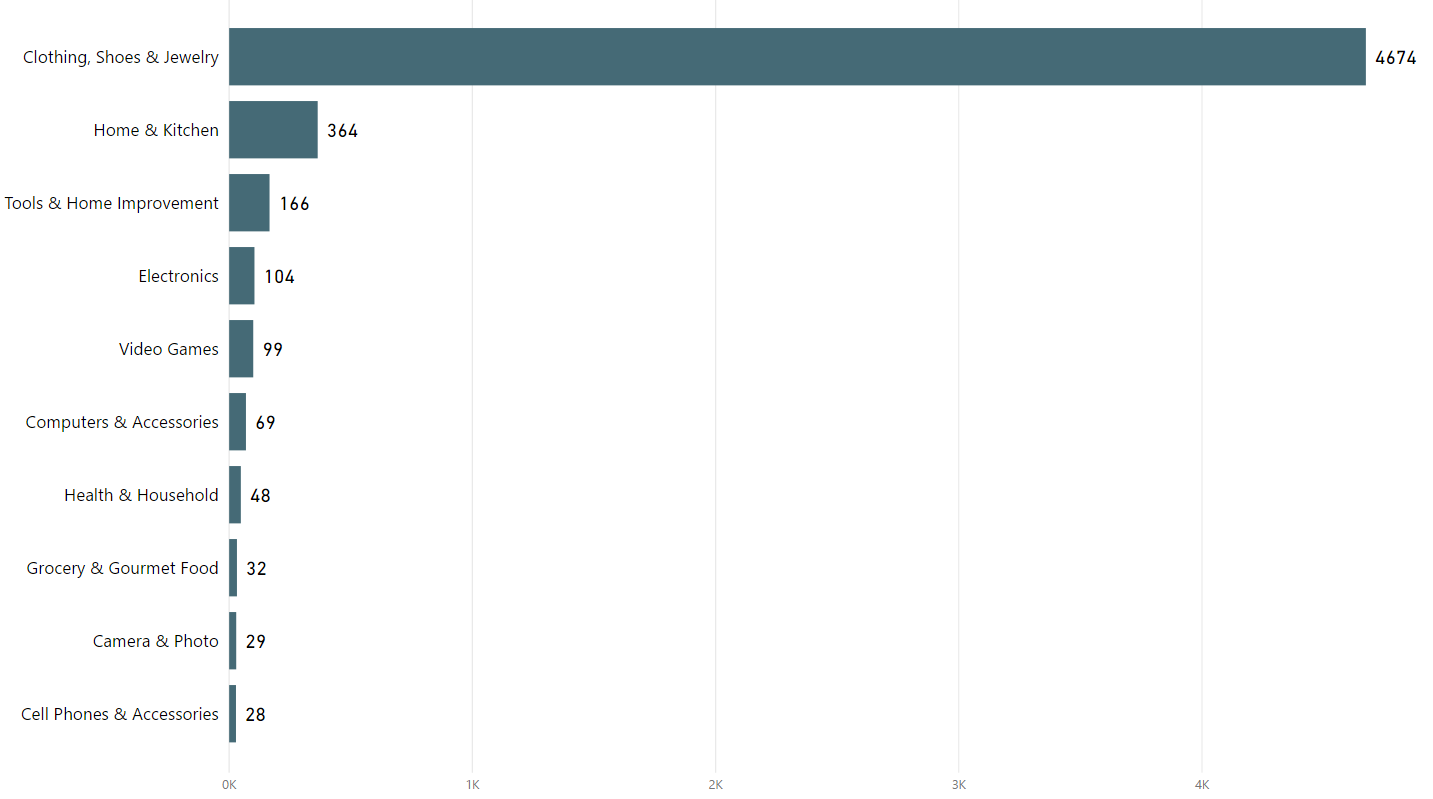

Amazon’s private-label offering contains 6,825 products across over 100+ identified private labels. 4,674 of those private-label products are in apparel.

The e-commerce giant offers everything from pet food to beauty products under its private-label collection. Most of the brand names are uncommon or unheard of.

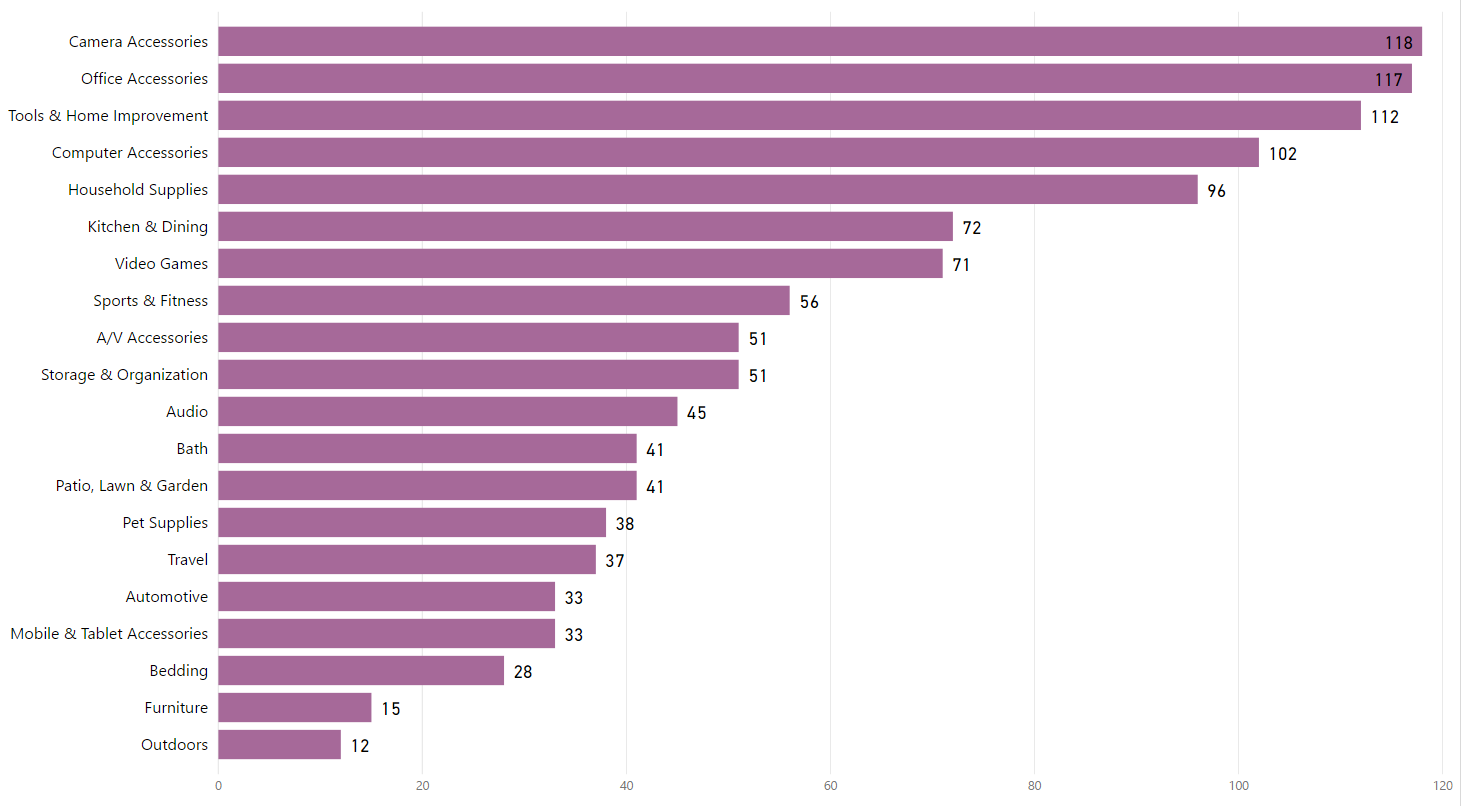

Since 2017, Amazon has gone on a private-label rampage, releasing brands primarily in the ‘Clothing, Shoes and Jewelry’ category, according to an April 2018 study from the research firm Gartner L2. The graph below shows the top 10 categories with the highest number of private-label products.

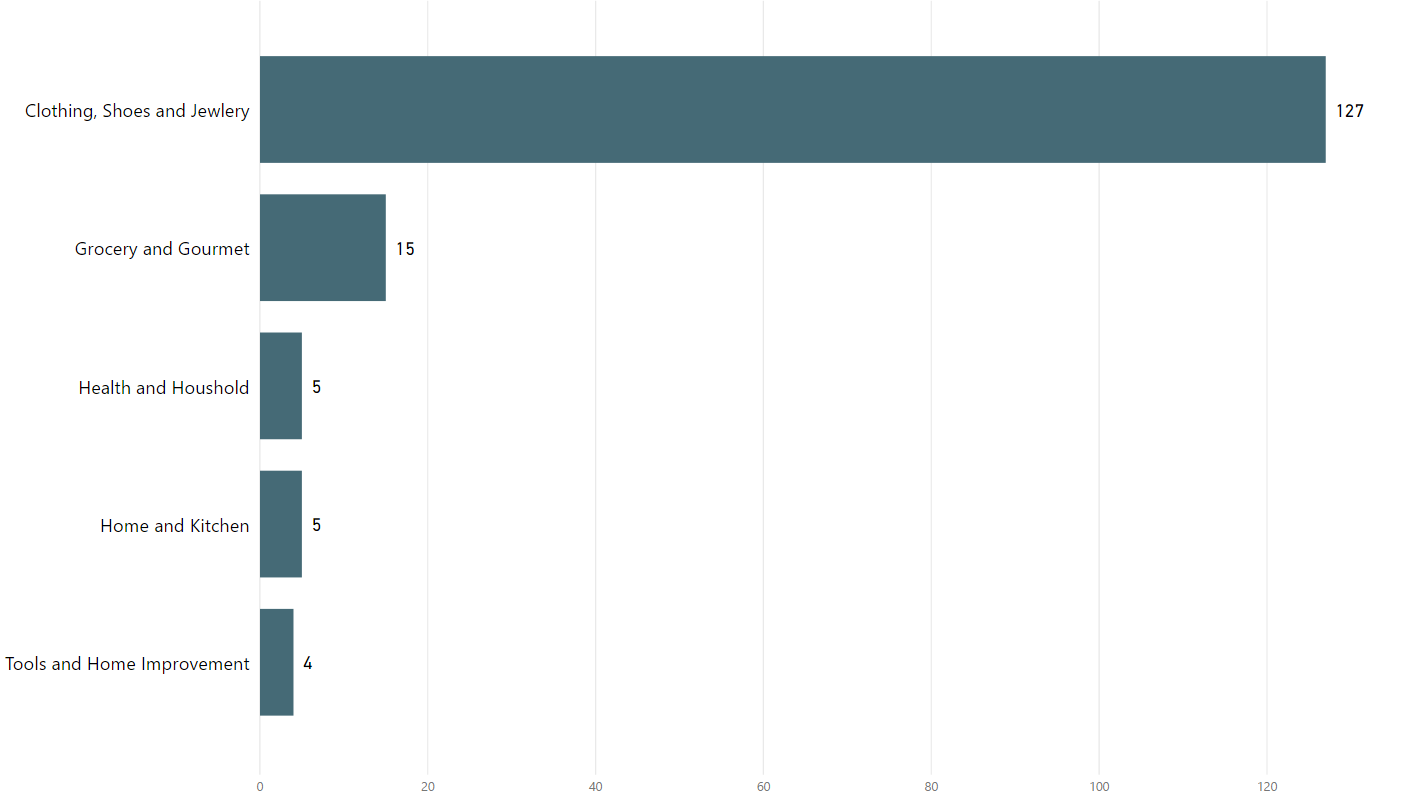

‘Clothing, Shoes and Jewelry’ take up three-quarters of all private-label products, followed by ‘Home & Kitchen’ and ‘Tools & Home Improvement’. Amazon’s apparel industry will only keep increasing. The chart below shows the number of private labels in the top five categories. There are already 127 labels under apparel.

A majority of private labels sell less than 50 products.

Home & Kitchen: With 364 products under the multi-category, AmazonBasics brand has three specialized private-label brands: home-textiles brand Pinzon by Amazon, and premium-positioned home-furnishings brands Rivet and Stone & Beam.

Health and household: This category includes Amazon Essentials, which was launched in 2014, and sells everything from multivitamins to baby-care products. The Presto and AmazonBasics brands offer products in health and household such as cleaning products. Amazon Elements, which used to carry only baby wipes, now sell vitamins and supplements.

Grocery & Gourmet Food: This account for brands Amazon Happy Belly and Wickedly Prime.

Amazon has been highly focused on expanding its private labels in recent months, moving to consumables, food-based packaged goods, baby food, fashion, and more. There is even an Amazon mobile app to check for the transparency of products.

Price

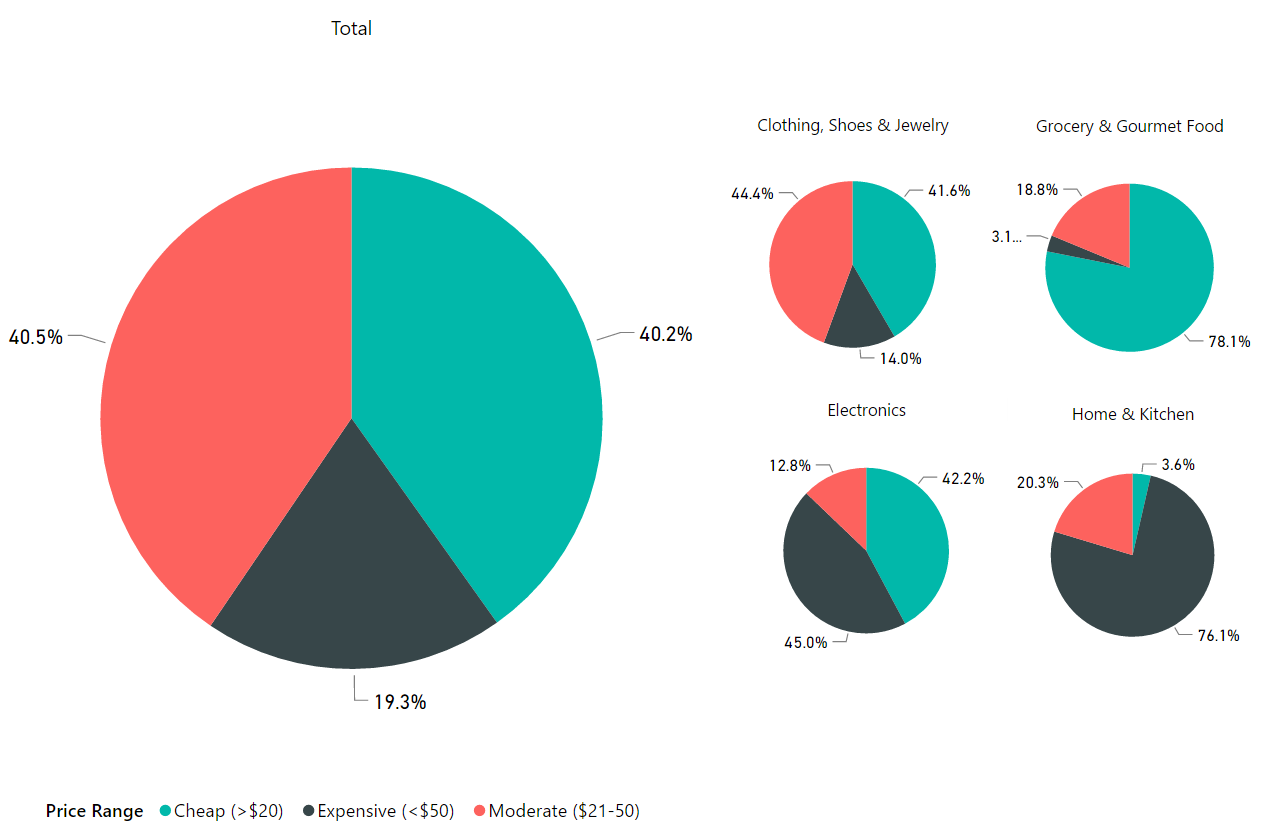

The prices at which Amazon sells their products are cheap. 40.5% of the total products are below $20. In the top 4 categories with the highest number of products, apparel and food items are mostly below $40. However, ‘Home & Kitchen’ has a majority of products above $50.

Amazon Fashion

Amazon is slated to become the largest apparel retailer by 2019. Its success, particularly in AmazonBasics, threatens huge market players such as Macy’s and Banana Republic. Amazon is expected to rise from $22 billion this year to $62 billion by 2021, and the proclivity toward private labels shows that fashion will be Amazon’s main game in 2018.

Becoming a Fashion PowerHouse

Amazon can grow in the fashion industry right now as the economics of retail break down, the web gains steam and stores traffic slips away. In the beginning, Amazon started with a couple of private labels in women’s clothing and slowly expanded to men’s clothing and athletic wear.

Amazon is a threat to the fashion industry because it’s a technology that the fashion industry ought to be embracing in a big way that others are not. Women’s clothing brand Lark & Ro (486 products), men’s shirts from Goodthreads (134 products), and accessories from The Fix (128 products) come in the top 10 brands.

AmazonBasics

Just like big retailers like Walmart and Target who have their own name-brands, Amazon quietly entered the business with their first brand AmazonBasics in 2009. If you are a frequent shopper at Amazon, it is hard to ignore AmazonBasics. It started out with utilities like cables, batteries, and chargers, but the results were stunning. Amazon reached higher sales than Duracell and Kirkland within a year.

The massive amount of purchase data that Amazon collects provides all the information they need to succeed. Amazon knows what customers are searching for, which listings they’re clicking on, and what products they ultimately purchase. Amazon describes their products as “everyday items…at a value”. Which is true; customers are searching for common items that are affordable and efficient.

Amazon’s strategy for AmazonBasics was to create versions of popular items, recreate them and sell them for a cost less than their name-brand counterparts. Now it is the biggest private label to date. We looked into Amazon.com to find out how many AmazonBasics products were up for sale on its landing page, how well the ratings were and the average prices of products up for sale.

AmazonBasics has a total of 1170 products available on Amazon.com (as of Sept 27, 2018)

The top categories are ‘Camera Accessories’, ‘Office Accessories’, and ‘Tools & Home Improvement’. Amazon is aggressively expanding their products, especially ones that are integrated with Alexa.

Price and Ratings:

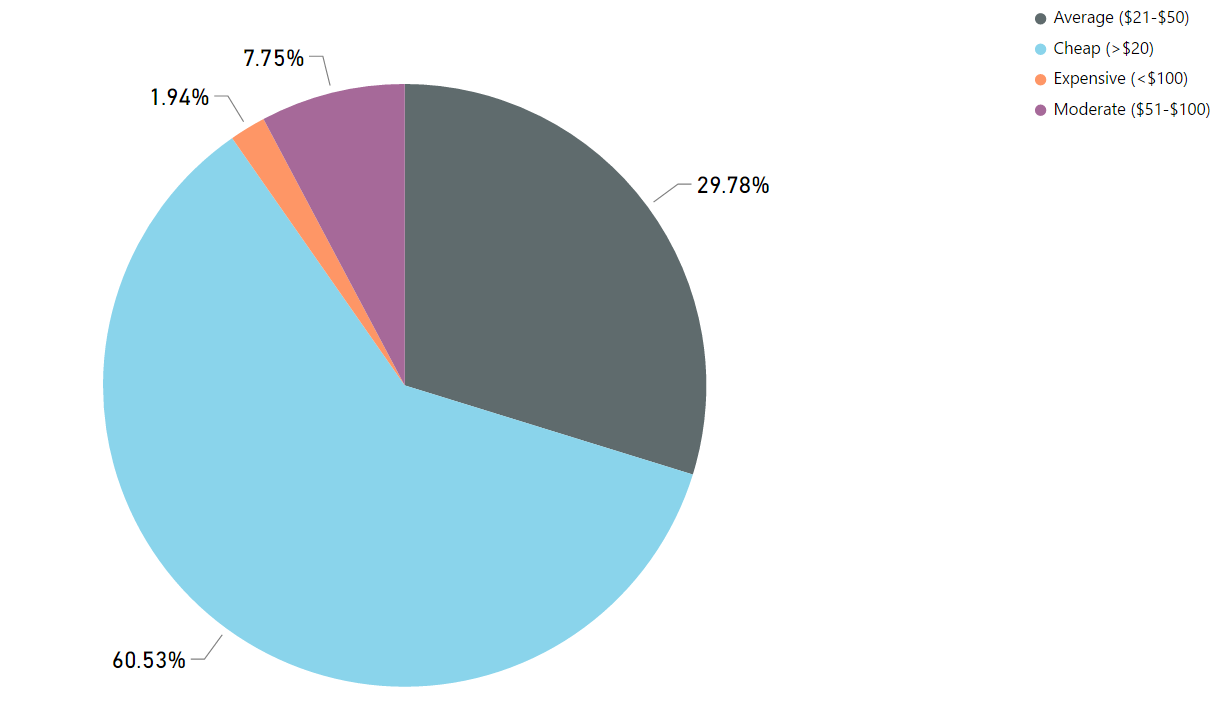

Pricing is the highlight of Basics. AmazonBasics are priced lower than similar products and sometimes are of better quality. 60.53% of products are less than $20 and only 1.94% are above $100.

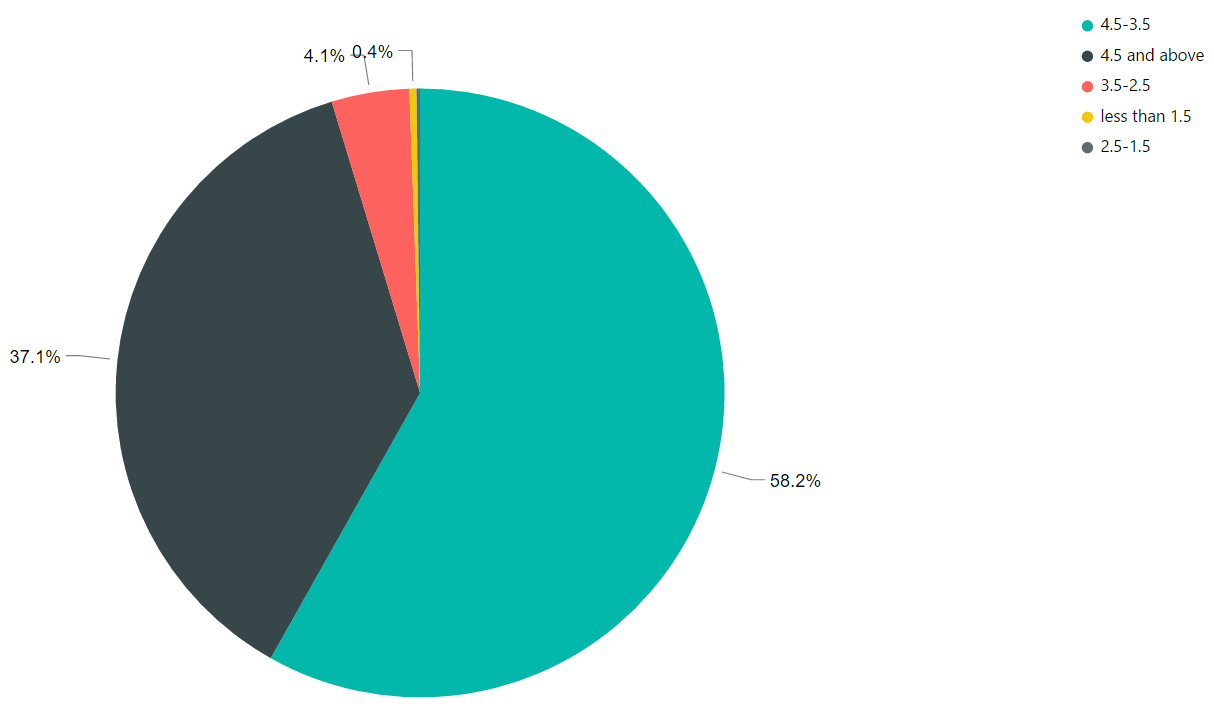

AmazonBasics is doing pretty well with ratings too. Most of their products are above 3.5 stars. AmazonBasics is great for shoppers who want generic products, but when it comes to discovering unique products, Amazon doesn’t fare well.

The pie chart below shows the number of products for within a range of ratings. 135 AmazonBasics products have a rating of 4.5. Around 58.2% products have a rating between 4.5. to 5 stars.

For a full list of Amazon private labels and other valuable data to be gathered from a variety of websites, contact us on the form below.

We can help with your data or automation needs

Turn the Internet into meaningful, structured and usable data