According to Statista, it is projected that the revenue of automobile dealers in the US. will amount to approximately $ 1.125,7 billion by 2024.

Understanding the location strategies of leading automobile dealers is thus vital for investors, aspiring dealership owners, and manufacturers.

This blog provides a comprehensive automobile dealer location analysis in the US, with insights into the market distribution and geographic reach of key players.

By examining the number of locations, revenue, and presence across cities and states, this analysis brings to light the strategies and trends shaping the automotive retail industry.

The data for this analysis was sourced from the ScrapeHero Data Store.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

On our platform, you can download accurate, updated, affordable, and ready-to-use POI location data of thousands of brands.

Who Are the Leading Automobile Dealers in the US?

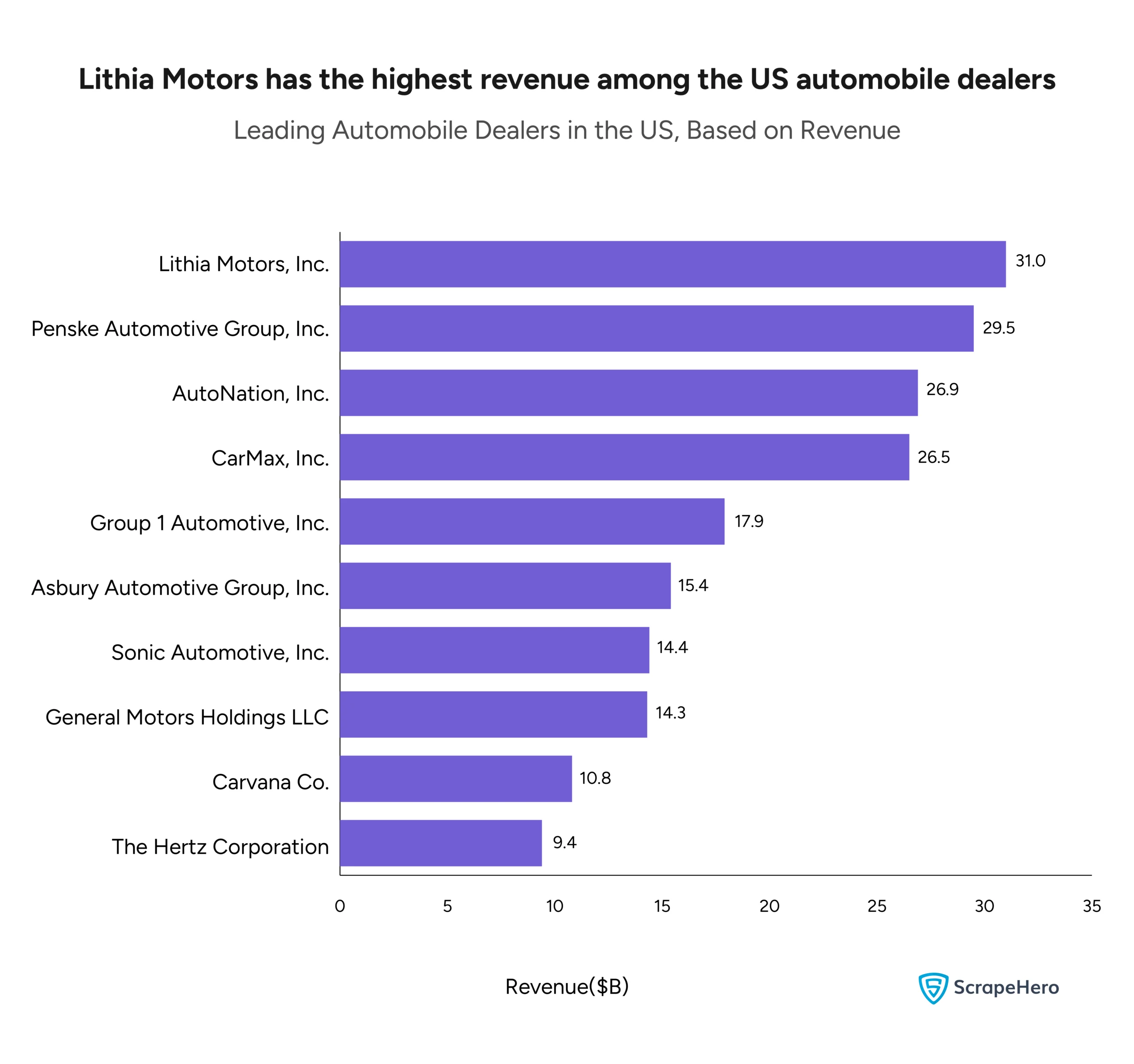

Before we get started on analyzing automobile dealer locations in the US, let us understand who the major players in the US are based on revenue.

Below is a graph showing the leading automobile dealers in the US, ranked based on their revenue in millions of dollars, according to Dun & Bradstreet.

From the graph, it can be inferred that:

- Lithia Motors, Inc. leads with a revenue of $ 31 billion.

- Penske Automotive Group, Inc. is close behind at $ 29.5 billion.

- AutoNation, Inc. ranks third with $26.9 billion.

- CarMax, Inc. follows closely at $26.5 billion.

Download the details of Lithia Motors dealership locations in the US here.

Lithia Motors and Penske Automotive lead with revenues significantly above the other dealers. The gap between the first two companies and the others is noticeable.

After the top four companies, there is a steep decline in revenue.

The automotive dealership market in the US is thus concentrated at the top, with a few companies controlling a significant share of the revenue.

Now, let us look at the distribution of the major automobile dealerships in the US.

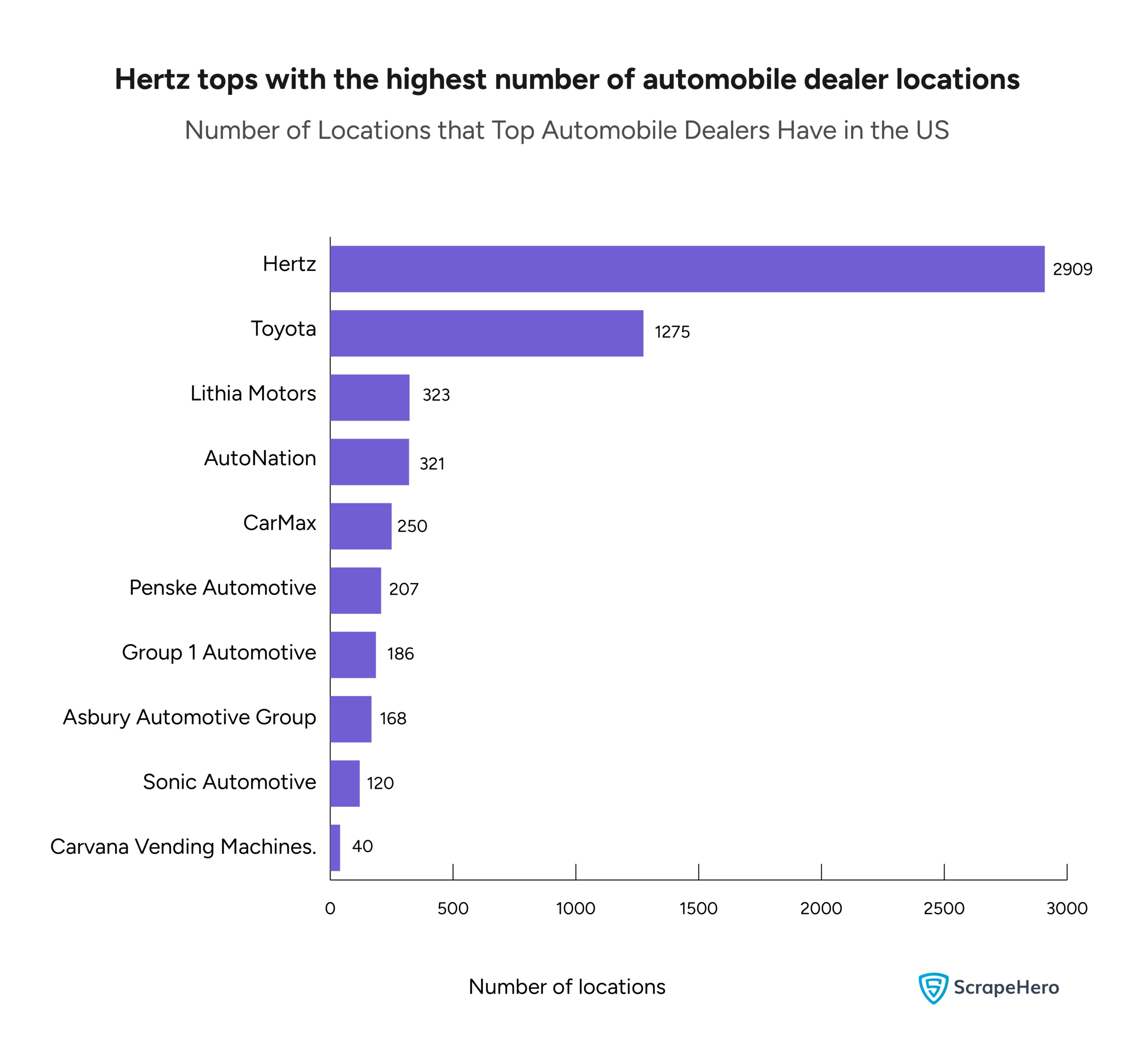

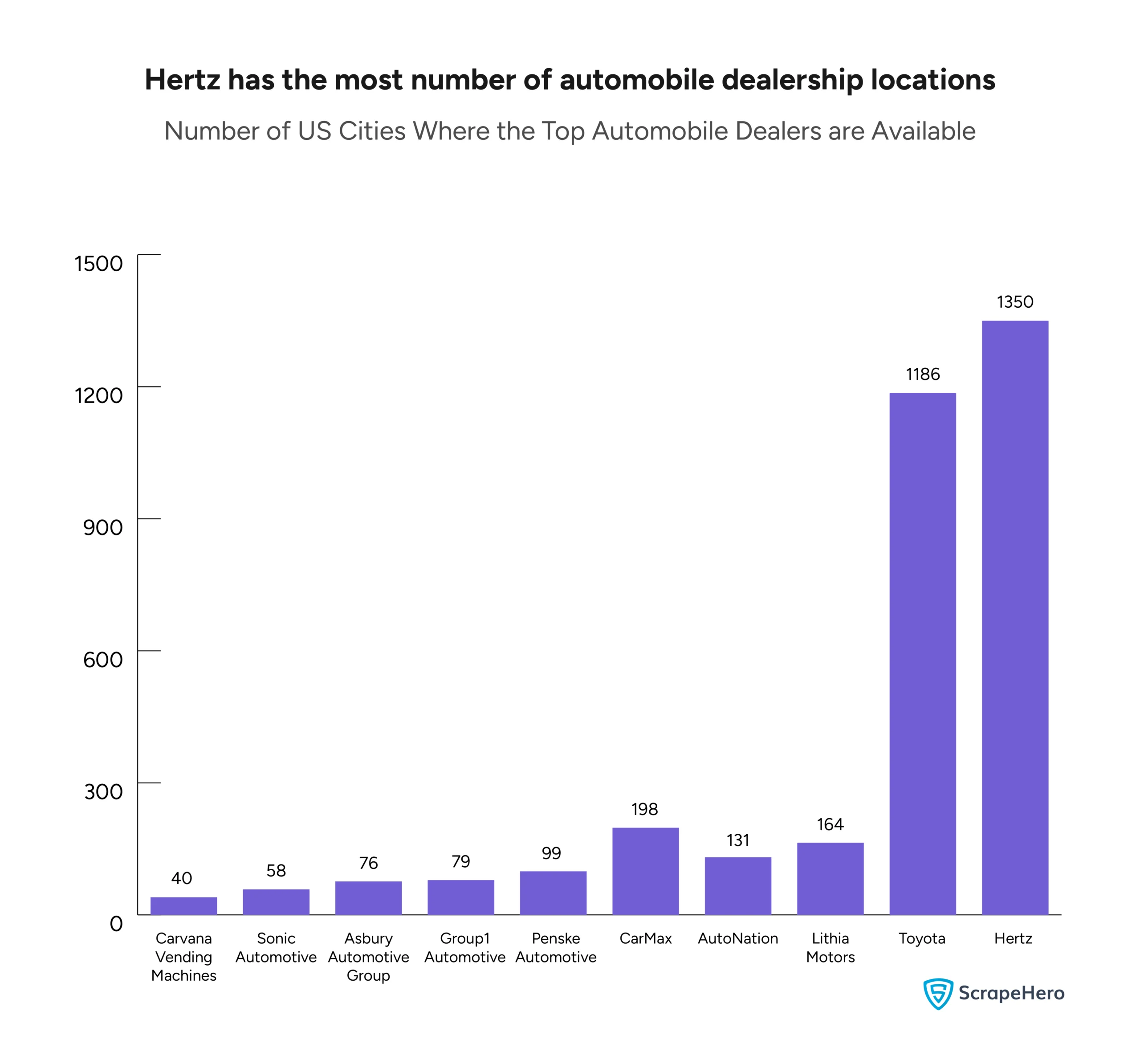

Number of Automobile Dealer Locations in the US

Hertz stands out with a significantly larger number of locations (2909), far surpassing the next closest competitor.

Toyota (1275 locations) and Lithia Motors (323 locations) occupy the second and third positions, respectively.

The remaining dealers have a distribution of locations ranging from 250 to 40.

It is interesting to observe that Lithia Motors and Penske Automotive lead the pack in revenue, but they have a relatively smaller number of locations compared to Hertz.

Hertz boasts the most locations nationwide, even though its revenue falls behind.

Get more details about Hertz store locations in the US here.

Analyzing Automobile Dealers Locations in the US Cities

Here’s a look at the geographic reach of the top automobile dealers in the US based on the number of cities they operate in.

Hertz and Toyota stand out with significantly higher numbers of cities (1350 and 1186, respectively). This indicates a broader geographic reach for these two companies across the US.

The majority of dealers (CarMax, AutoNation, Lithia Motors, and Group 1 Automotive) have a similar number of cities (around 100-200).

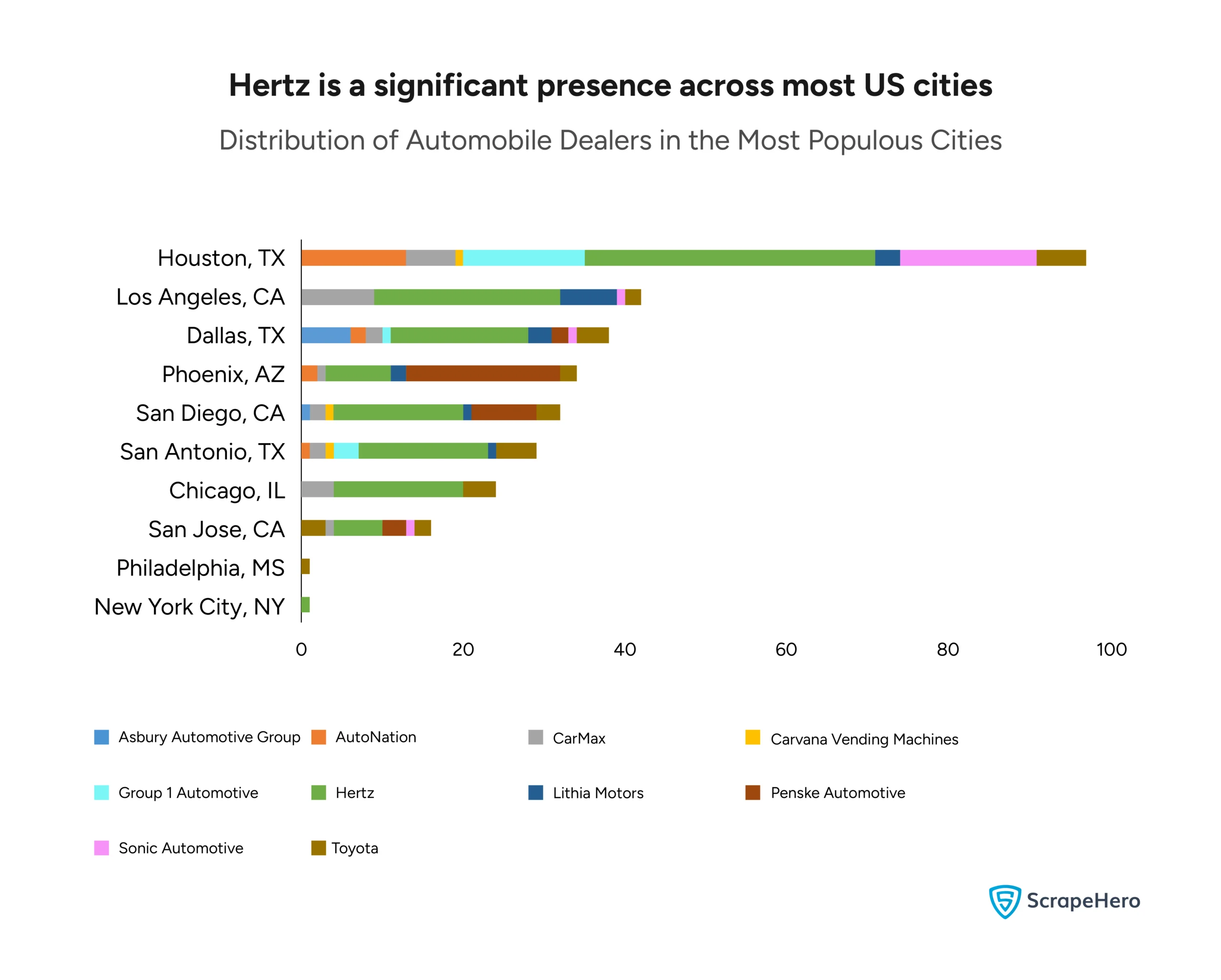

Distribution of Automobile Dealers in the Most Populous Cities

Hertz clearly has a significantly higher number of locations in all cities except Philadelphia.

Other dealers have a more varied presence across cities. Some cities have a significant number of their locations, while others have a smaller or even zero presence.

For instance, Penske has a significant presence in Houston but is almost negligent in other cities.

The presence of a dealer in a particular city might reflect their business strategy. Some dealers might focus on larger cities, while others might target smaller markets.

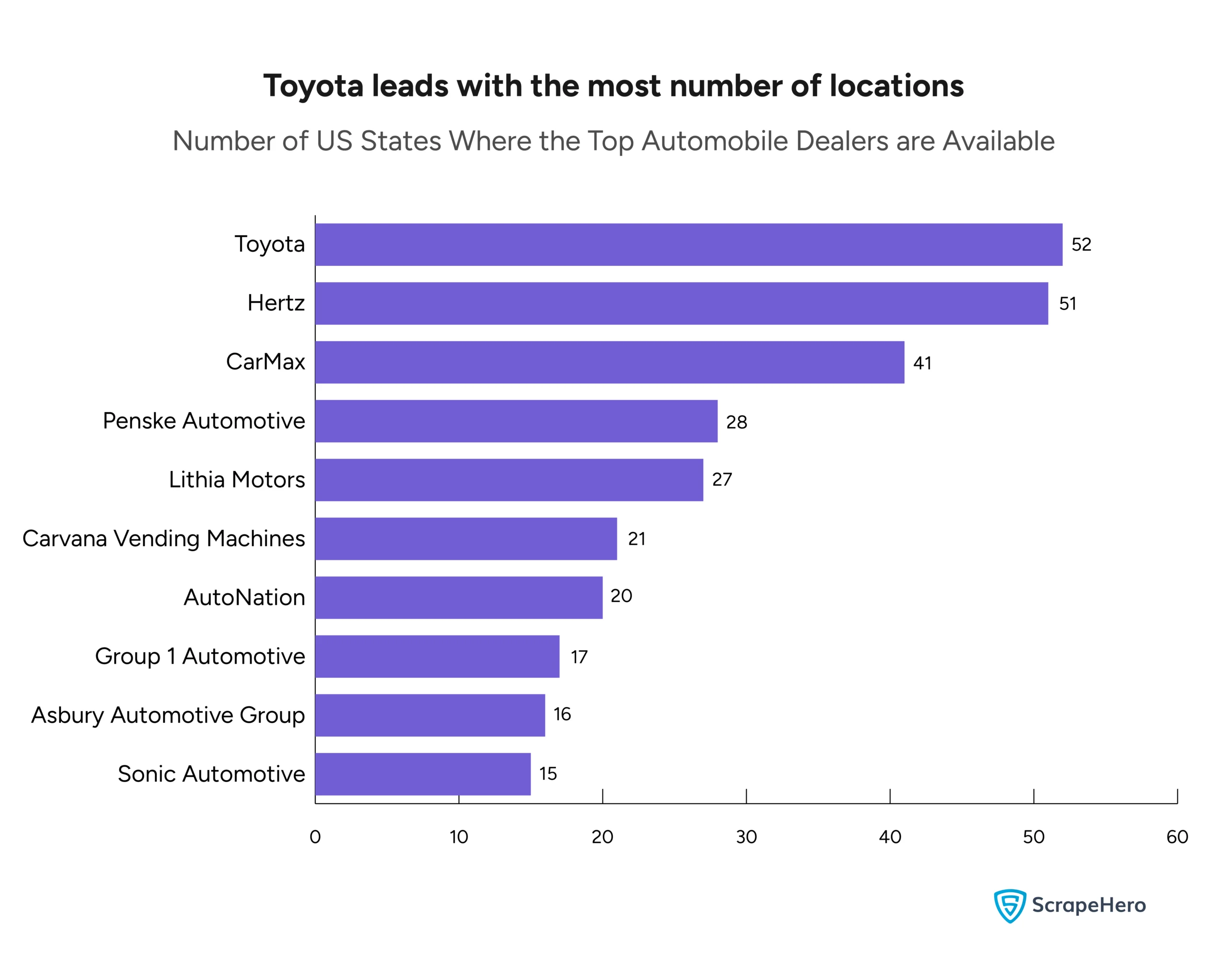

Analyzing Automobile Dealers Locations in the US States

Let us look at the number of states where the top automobile dealers in the US have a presence.

Toyota and Hertz have a presence in the number of states (52 and 51, respectively). This indicates a strong national presence for these two companies.

The other dealers have a varied presence across states.

Some dealers, like CarMax, Penske Automotive, and Lithia Motors, have a presence in a significant number of states. In contrast, others like Sonic Automotive and Asbury Automotive Group have a more limited presence.

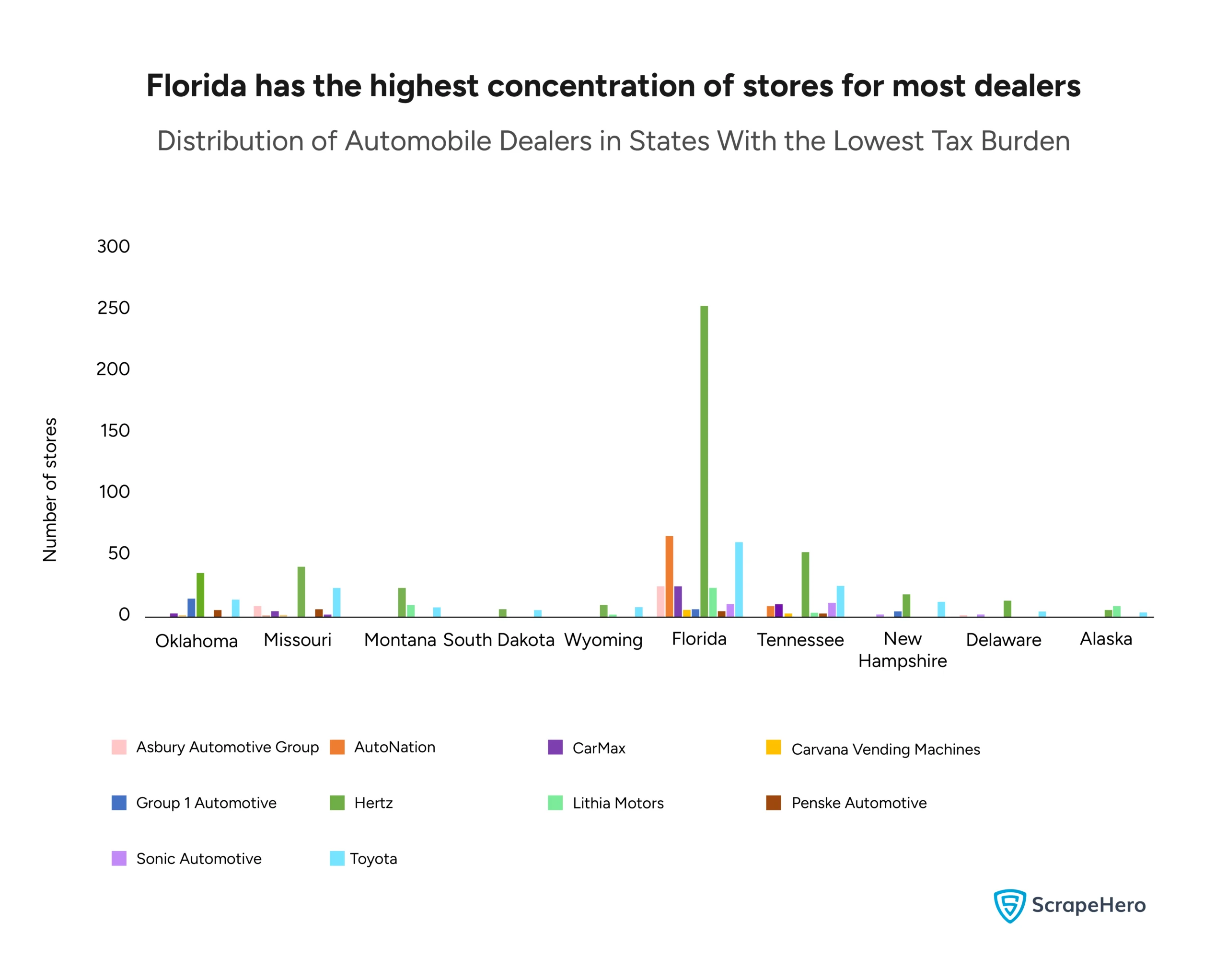

Distribution of Automobile Dealers in States With Low Taxes

We analyzed how the automobile dealers are located in the states with the lowest tax burden. This information about the states with the lowest tax burdens is gathered from Intuit Turbotax.

Hertz stands out with a significantly higher presence across these US states. It has a presence in all ten states.

Florida stands out as the state with the highest concentration of stores for most dealers.

Other low-tax states like Oklahoma, Missouri, and Tennessee have a more varied presence of dealers.

Some dealers, like Carvana Vending Machines, have a significant presence in these states, while others have a smaller or even zero presence.

What Did the Automobile Dealers Location Analysis in the US Reveal?

While revenue is an important indicator of success in the automotive retail market, the number of locations and geographic reach are also crucial factors to consider.

Hertz, for instance, boasts the highest number of locations and a broad presence across cities and states, even though its revenue falls behind other industry giants.

Different companies employ distinct location strategies.

Some, like Hertz and Toyota, prioritize a wide geographic reach, evidenced by their presence in almost every state.

Others might focus on specific regions or target high-population centers.

Understanding these strategies can provide valuable insights for potential investors, aspiring dealership owners, and manufacturers.

The concentration of dealerships in states with low tax burdens, particularly Florida, suggests that business environment factors also influence location decisions.

This highlights the importance of considering not just market factors but also regulatory and economic conditions when analyzing the US automotive retail landscape.

Want Data for Analysis?

You likely recognize the importance of having data related to your area of interest. Data empowers you to analyze and comprehend trends and patterns.

However, collecting this data can be challenging. It often requires navigating complex sources, ensuring accuracy, and dedicating substantial time and resources to extract data consistently.

If you need data to understand the automotive industry or any other industry, we recommend partnering with an experienced web scraping service provider like ScrapeHero.

With over a decade of experience, unmatched quality and consistency, and the best crawling infrastructure, ScrapeHero is the best decision you can make for your web scraping needs.