When it comes to fashion, the US isn’t just participating—it’s leading the charge.

According to Statista, in 2024, Americans spent a whopping $558.49 billion on clothing and footwear, making it the biggest fashion market in the world.

But how is this spending distributed across the country, and who are the major players capturing this massive market?

To explore this, we analyzed the 23 top fashion retailers in the US to highlight the key trends and geographical hotspots defining the American fashion retail landscape.

The top US Fashion Retailers under analysis are Adidas, American Eagle Outfitters, Anthropologie, Banana Republic, Bloomingdale’s, Coach, Forever 21, Gap, Gucci, Kohl’s, Louis Vuitton, Lululemon, Macy’s, Madewell, Marshalls, Nike, Nordstrom, Ross Stores, TJ Maxx, Under Armour, Urban Outfitters, Victoria’s Secret, and Zara.

This analysis was made possible by the easily downloadable retail store location data from the ScrapeHero Data Store.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

Fashion Retailers in the US: Market Overview and Key Players

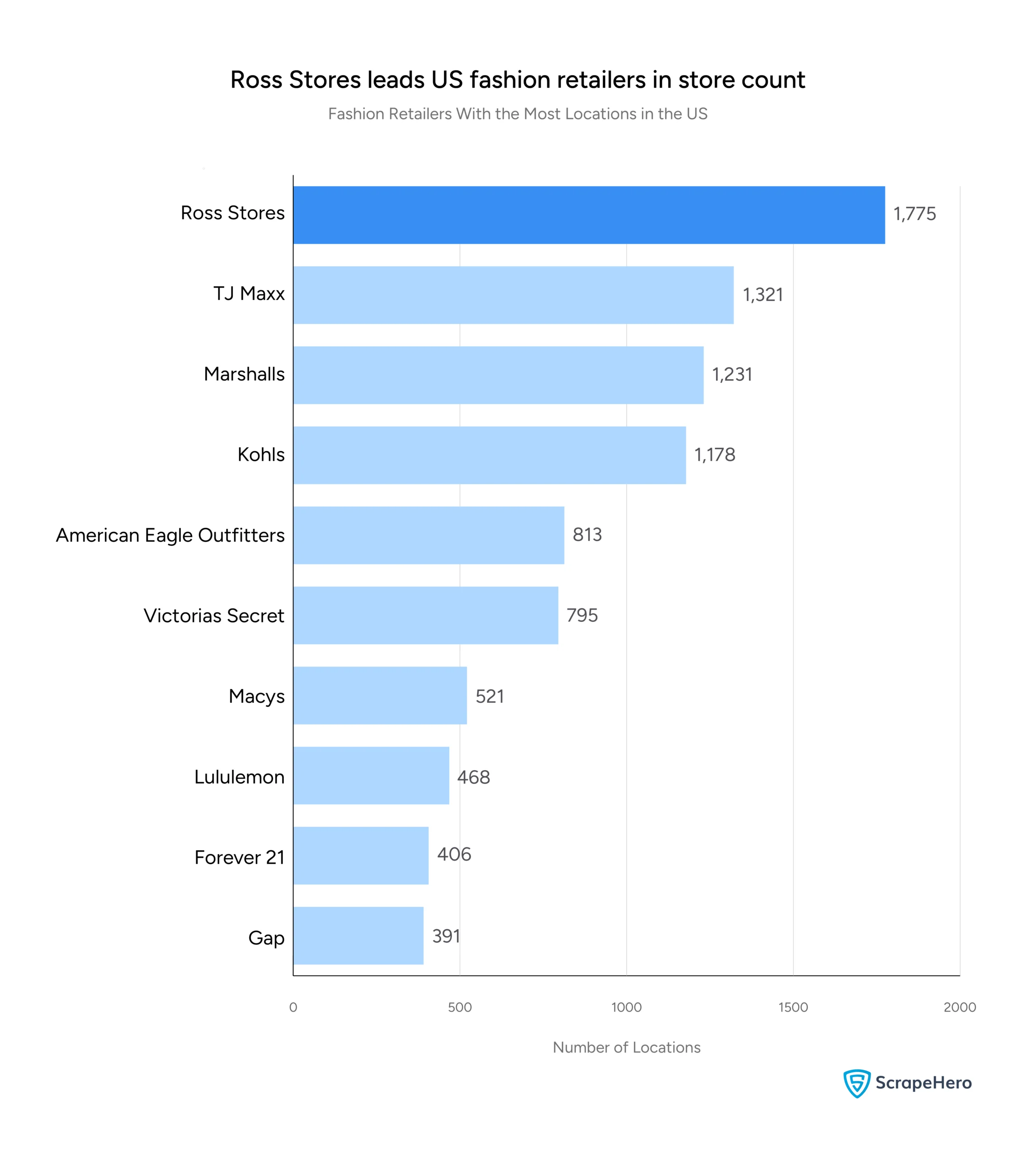

Fashion Retailers With the Most Locations

Among the 23 top US fashion retailers, these are the brands with the most number of locations.

Ross Stores tops the list with 1,775 locations. Following closely are TJ Maxx with 1,321 locations and Marshalls with 1,231.

Kohls maintains a strong presence with 1,178 locations.

Next on the list are American Eagle Outfitters (813 locations) and Victoria’s Secret (795 locations).

Luxury athletic brand Lululemon comes next with 468 locations.

Fast-fashion retailers Forever 21 (406 locations) and Gap (391 locations) come next on the list of the top fashion retailers in the US.

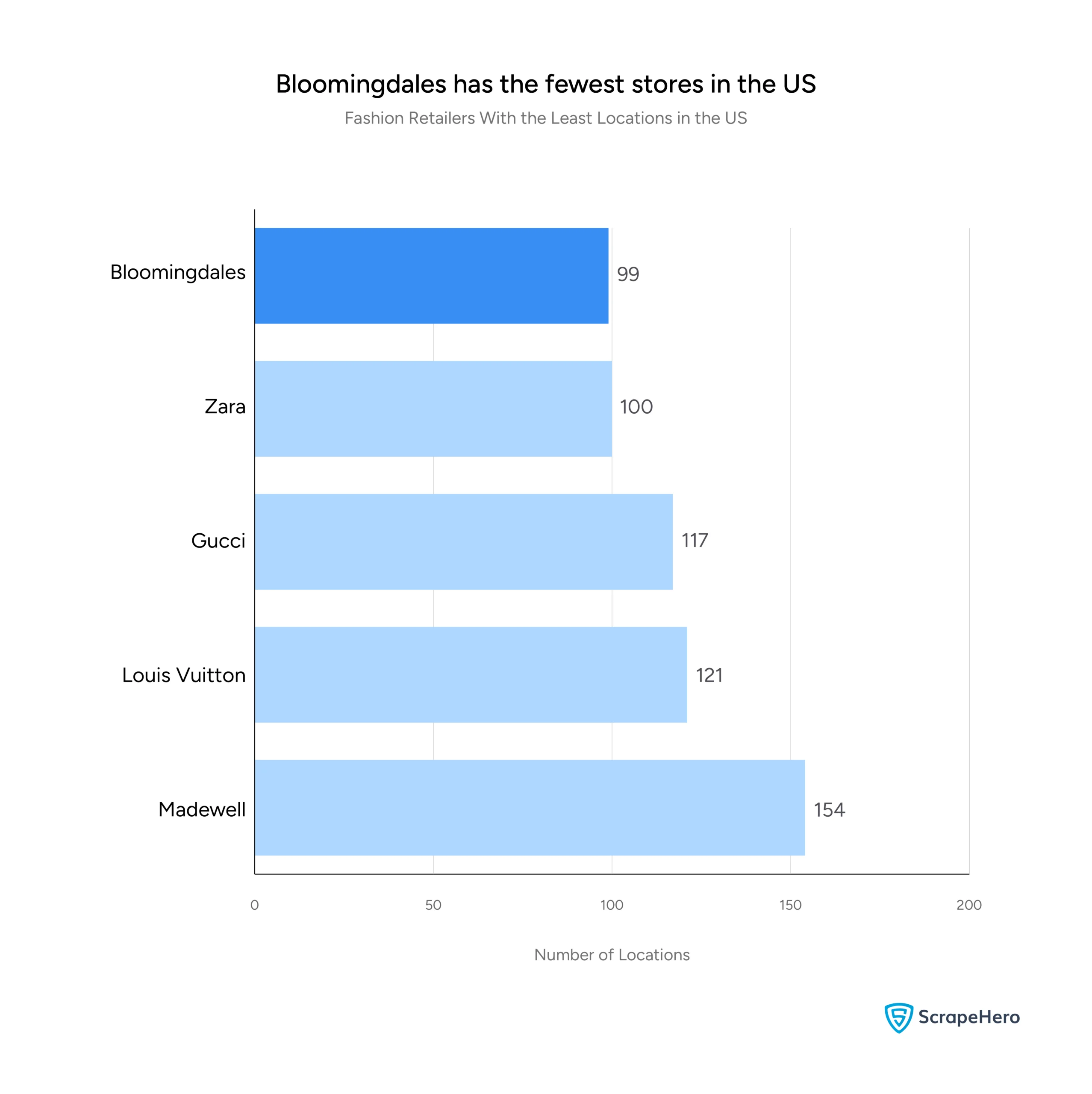

Fashion Retailers With the Least Locations

While many fashion retailers focus on widespread physical expansion, some brands take a more selective approach to their brick-and-mortar presence.

These are the fashion retailers with limited locations in the US.

Bloomingdale’s has the fewest locations on this list, with 99 stores.

The complete list of all Bloomingdale’s store locations in the US with geocoded address, phone numbers, open hours, stock ticker, etc, is available for instant download.

Zara operates 100 stores across the US.

Gucci has 117 locations.

Louis Vuitton follows with 121 locations.

Madewell has the highest number of locations among the least widespread retailers, with 154 stores in the US.

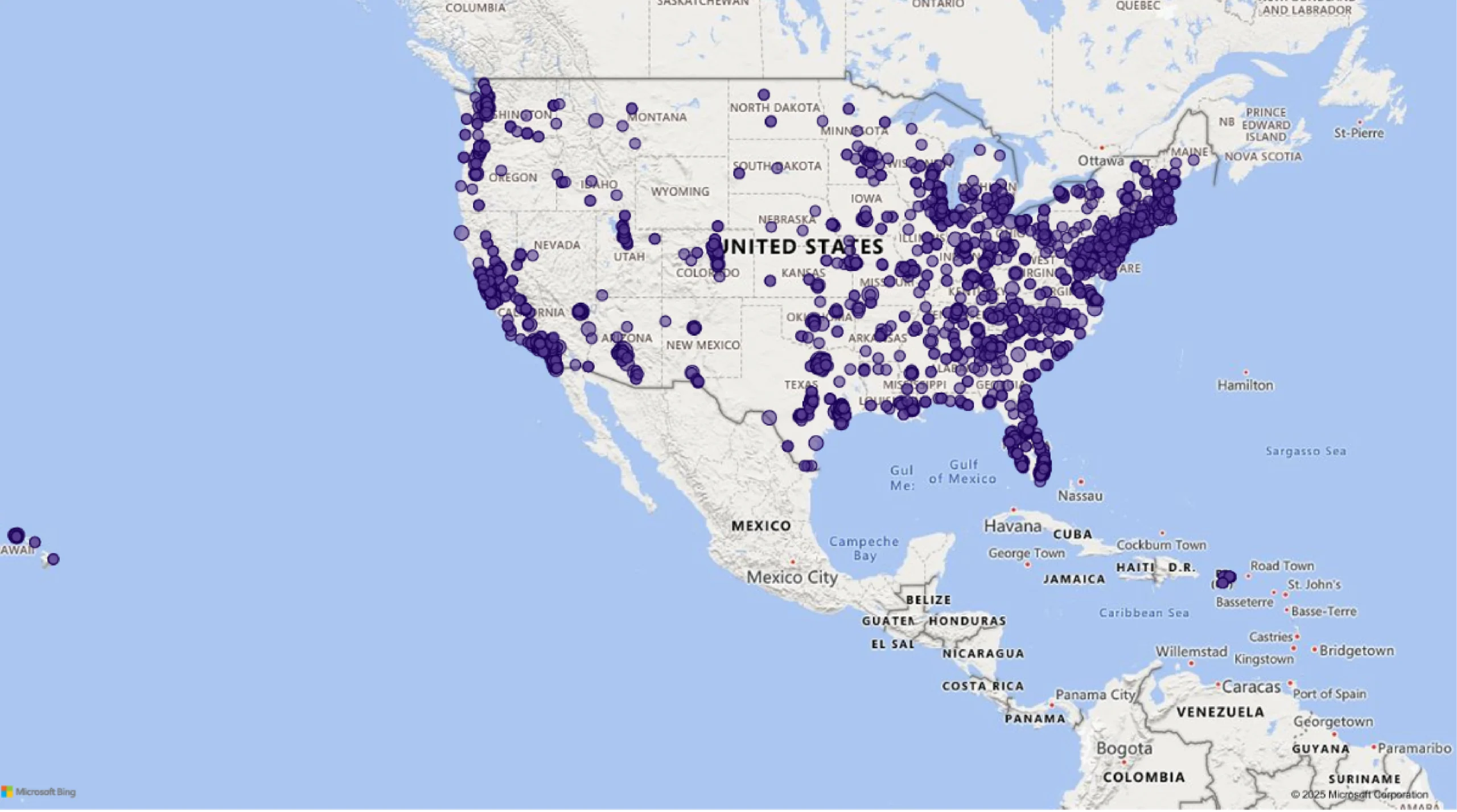

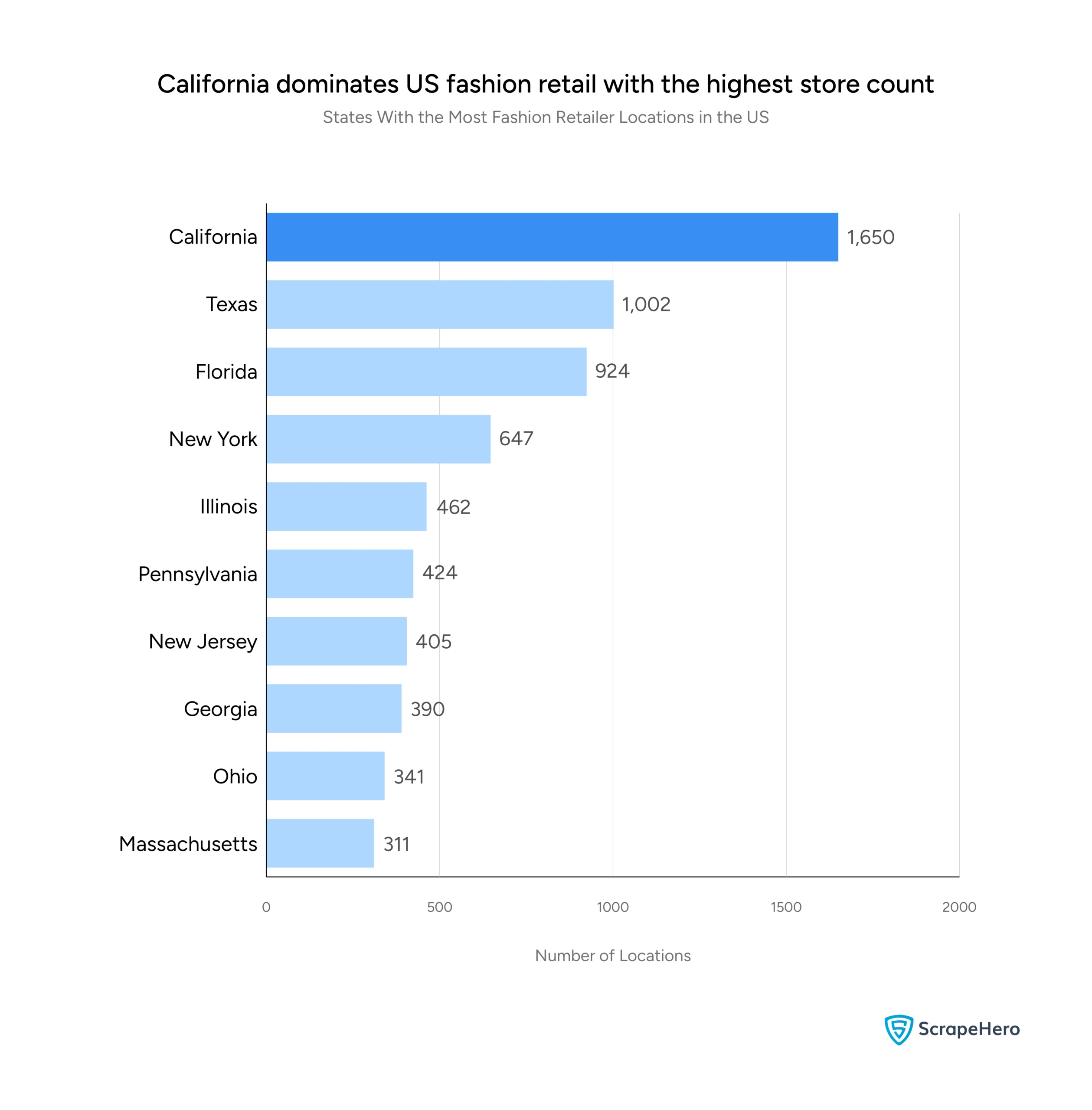

Geographical Distribution of the Top US Fashion Retailers

States With the Most Locations

The distribution of top US fashion retailers across the US reveals key regional hubs that serve as major markets for the industry.

California stands out as the clear leader, hosting 1,650 locations.

Texas ranks second with 1,002 locations.

In third place, Florida has 924 stores.

New York, a global fashion capital, houses 647 locations.

The Midwest and Northeast are represented by states like Illinois (462 locations), Pennsylvania (424 locations), and New Jersey (405 locations).

Georgia (390 locations) and Ohio (341 locations), next on the list, represent southern and midwestern markets.

Massachusetts rounds out the top ten with 311 locations.

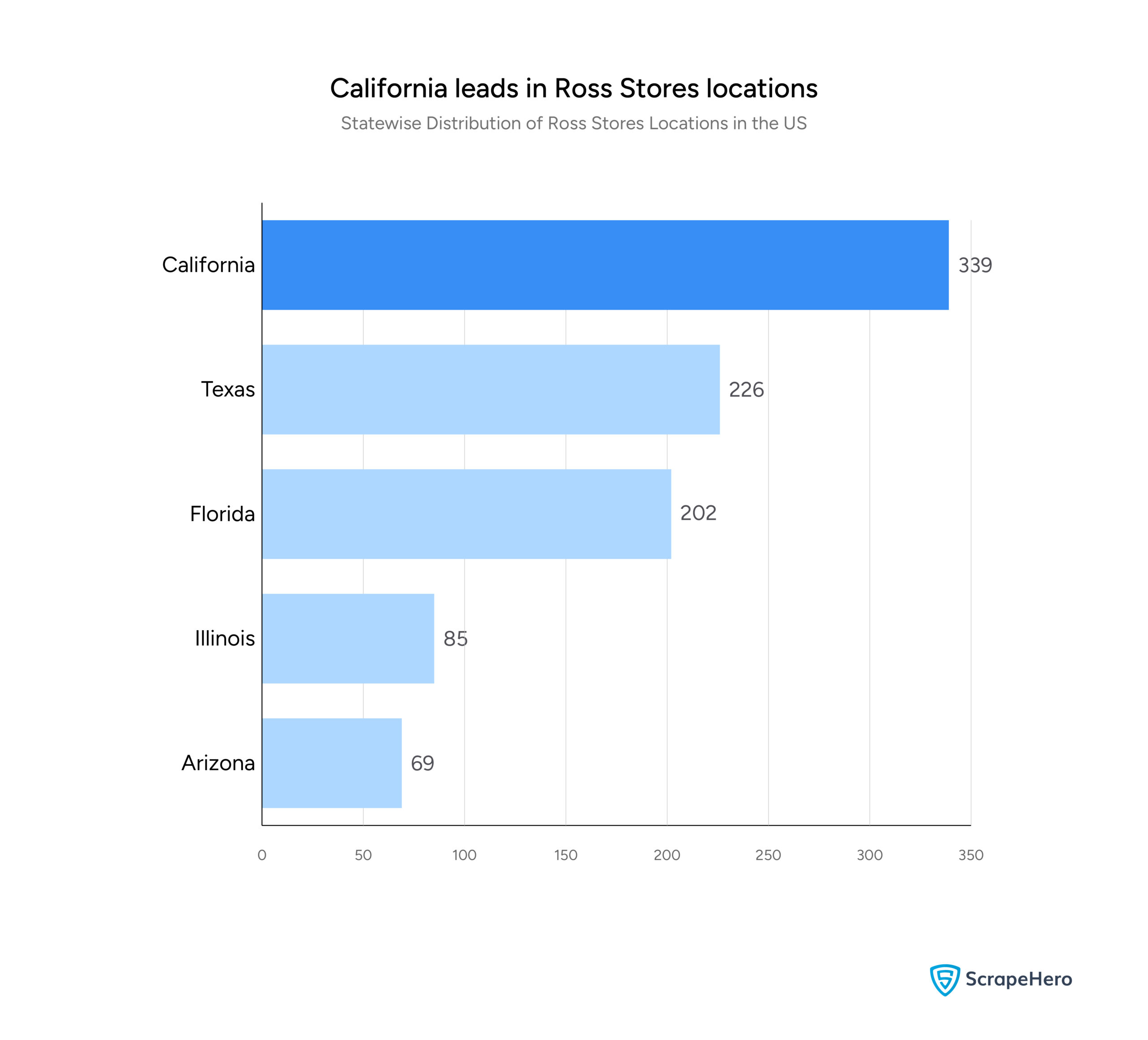

States With the Most Ross Stores

Ross Stores, known for its off-price retail model, has strategically concentrated its locations in key US states.

California is the clear leader, hosting 339 Ross Stores locations.

Texas comes in second with 226 locations.

Florida follows closely with 202 stores.

In the Midwest, Illinois supports 85 Ross Stores locations.

Arizona rounds out the top five with 69 locations.

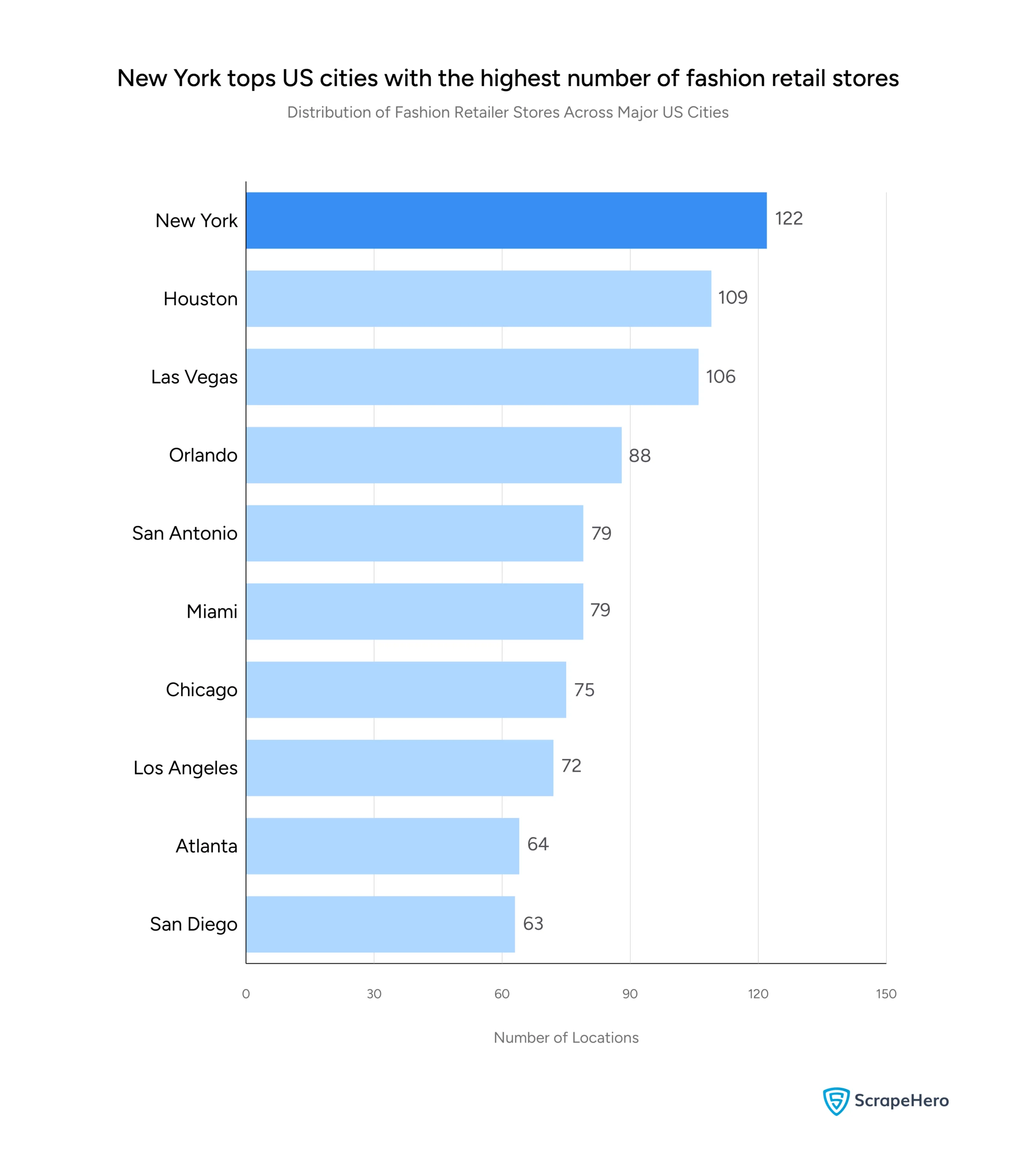

Cities With the Most Fashion Retail Locations

New York City leads the chart with 122 fashion retail locations.

Houston ranks second with 109 stores.

Las Vegas comes third with 106 locations.

Orlando follows with 88 stores.

San Antonio and Miami tie with 79 locations each.

Chicago holds 75 locations.

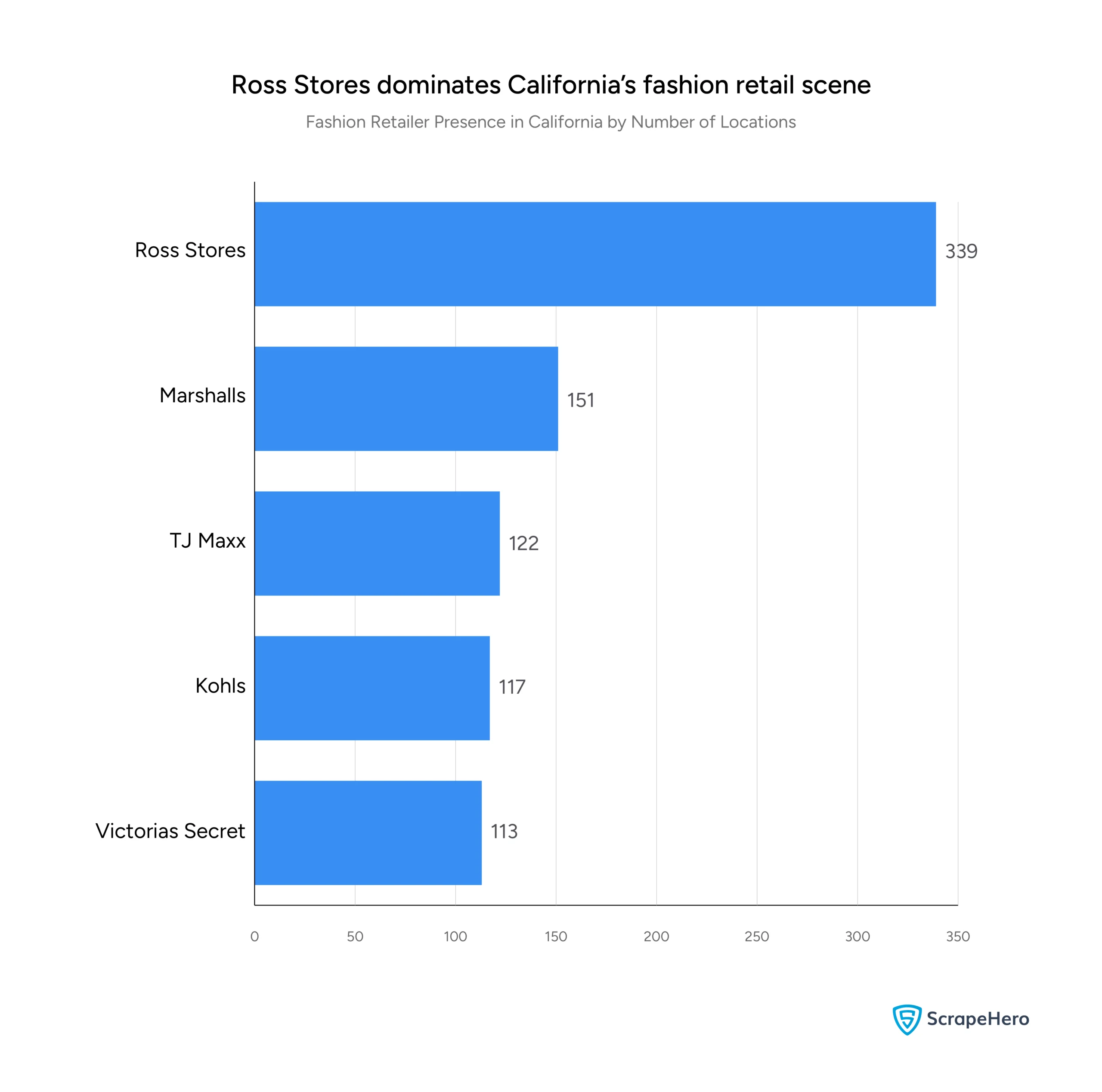

California: A Closer Look

California presents an attractive market for fashion retailers.

Here’s a graph highlighting the brands with the strongest physical presence in the state.

Ross Stores stands out significantly, with 339 locations across California.

Marshalls follows with 151 stores.

TJ Maxx, another player under the same parent company as Marshalls, operates 122 stores in California.

Kohls, with 117 locations, and Victoria’s Secret, round out the top five with 113 locations.

Wrapping Up: Key Takeaways on the Top Fashion Retailers in the US

In conclusion, the US fashion retail landscape, fueled by a massive $558.49 billion in spending in 2024, is dominated by a mix of widespread and selective retailers. Here’s a brief overview:

- Ross Stores leads in the number of locations nationwide, followed by TJ Maxx and Marshalls.

- Bloomingdale’s has the fewest locations among the top retailers.

- California is the state with the most fashion retail locations, and New York City leads among cities.

- California also has the most Ross Stores locations.

Need a Similar Data Deep Dive?

While you can easily access over 2,000,000 POI data points for more than 3,000 brands across 30+ industries from the ScrapeHero DataStore, partnering with ScrapeHero’s web scraping service is the ideal choice if you identify with any of the following scenarios:

- If you require substantial amounts of data and need assistance with the extraction process.

- If web scraping isn’t your primary business activity, outsourcing to ScrapeHero can save you valuable time and ensure data accuracy.

- If you need to target specific data points or navigate complex website structures.

As a full-service data provider, we eliminate the need for software, hardware, or specialized scraping skills. We handle everything, allowing you to focus on using the data to drive your business forward.

Connect with ScrapeHero today.