For regional supermarkets and grocery chains, achieving success requires the balance between the demands of a rapidly evolving consumer base and financial necessity in a competitive environment. As Walmart and Amazon-owned Whole Foods vie for a larger piece of the grocery industry market share, regional chains introduce tailored options to distinguish themselves as a part of their survival strategy.

We looked into the locations of regional and independent grocery chains in the Northeast, South, West, and Midwest regions of the US.

| Region | Major Regional Chains | Total Number of Stores | Dominant Chain |

|---|---|---|---|

| Northeast | Shop&Stop, ShopRite, Save A Lots, BJ’s, Weis Markets, Giant Eagle, Wegmans | 1,351 | Stop&Shop (418) |

| South | Publix, Food Lion, Save A Lot, Winn Dixie, H-E-B, Piggly Wiggly, Bi-Lo | 3,996 | Publix (1,234) |

| West | Safeway, Associated Food Stores, Albertsons, Sprouts Farmers Market, Whole Foods, King Soopers | 1,995 | Safeway (377) |

| Midwest | Save A Lot, Hy-Vee, Fareway, Piggly Wiggly, Dillons, Saveway | 996 | Save A Lot (387) |

Insights in Brief

- Stop and Shop has the most stores in the Northeast with 418 stores in 5 states

- Publix is the biggest regional grocery chain in the South with 1,234 stores in 7 states

- Save A Lot has 387 stores in 5 Midwest states

- Safeway dominates the western region with 377 stores in 11 states

You can download all top grocery stores in US from our data store.

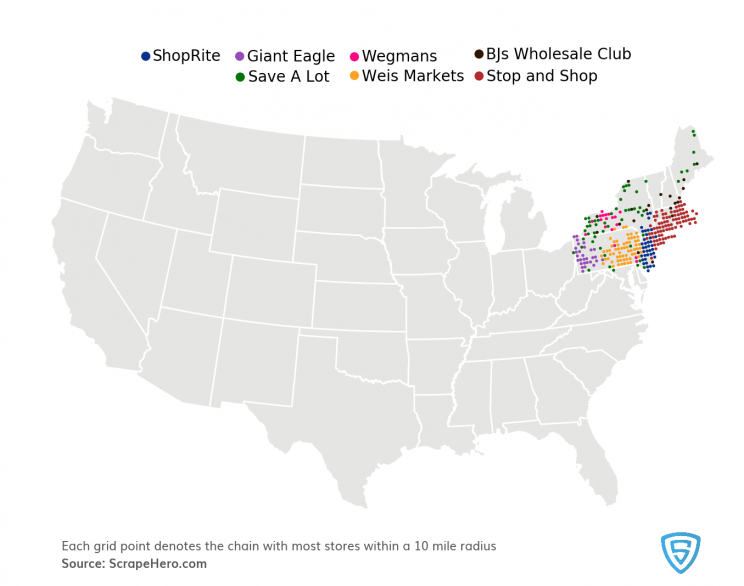

Northeastern Grocery Chains Map

Stop and Shop stores are concentrated in Connecticut, Massachusettes, and Rhode Island while ShopRite stores dominate New Jersey.

Pennsylvania has both Weis Markets and Giant Eagle stores concentrated on opposite sides of the state. BJ’s Wholesale Club and Save-A-Lot stores reign in Maine, New Hampshire, and upper areas of New York. Wegmans, a private chain that started in New York is mainly present in its home state, with a few stores in Pennsylvania, New Jersey and Massachusetts.

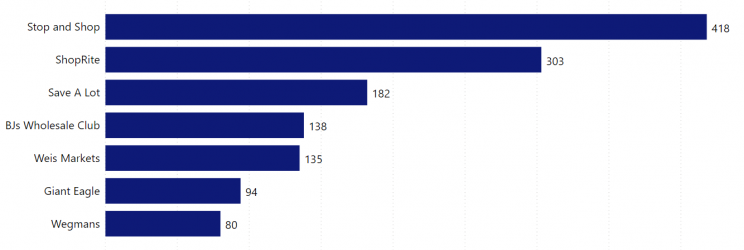

Number of Stores in the northeastern states by each Chain:

Stop & Shop has 418 stores in 5 states. ShopRite has 303 stores with 60% of its locations in New Jersey.

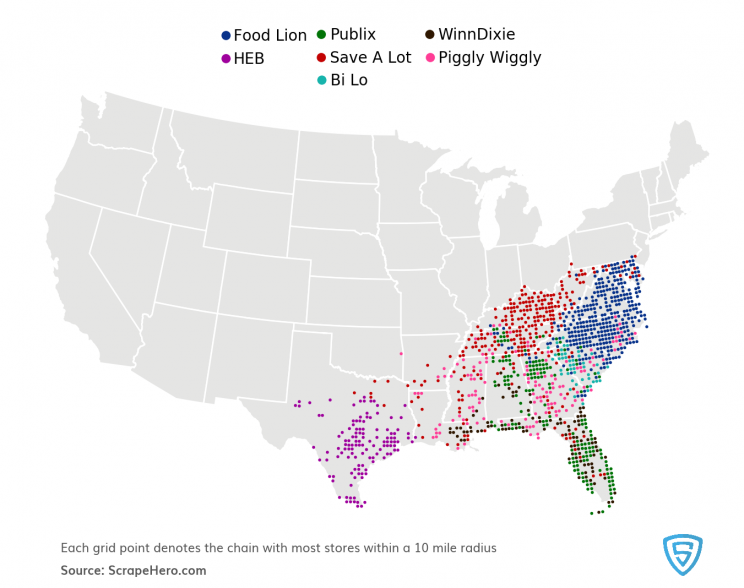

Southern Grocery Chains Map

Food Lion, which started in North Carolina has a strong presence in the South-Atlantic states – Maryland, Virginia and North Carolina. Florida is dominated by Publix and Winn-Dixie stores, which makes sense as both are headquartered in Florida.

Texas chain, H-E-B dominates in its home state, with a few stores in Louisiana. According to a 2020 grocery retail report, H-E-B ranks number one as America’s trusted grocer.

Read More – Grocery Chains Offering Curbside Pickup

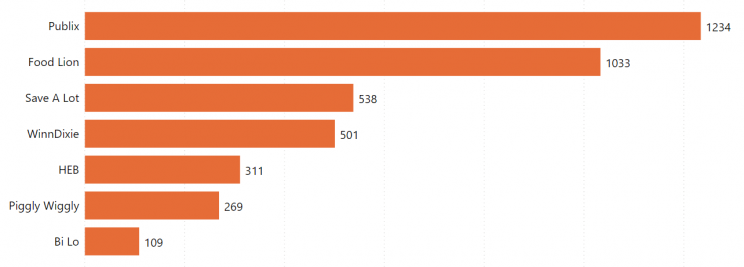

Number of Stores in the southern states by each Chain:

Publix stores are in 7 southern states, with 65% of stores located in Florida. Food Lion is highly concentrated in the South Atlantic states, with 55% of total locations in North Carolina and Virginia.

Of the 501 Winn-Dixie stores, 407 are located in Florida.

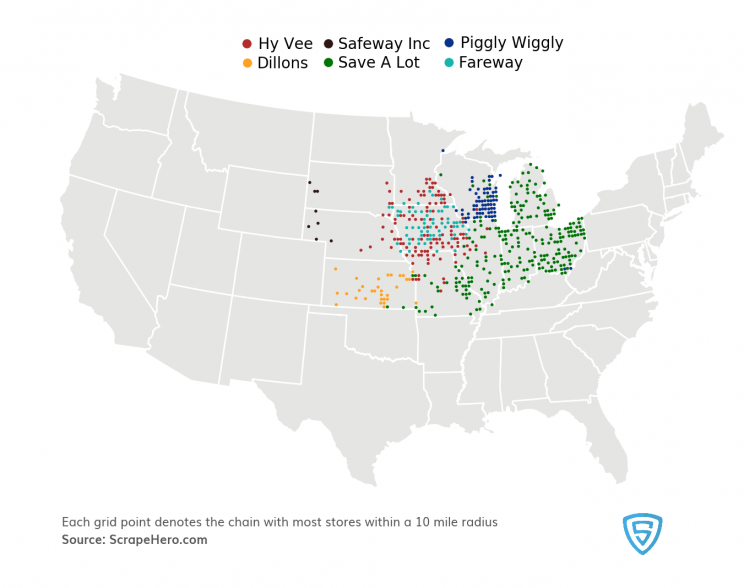

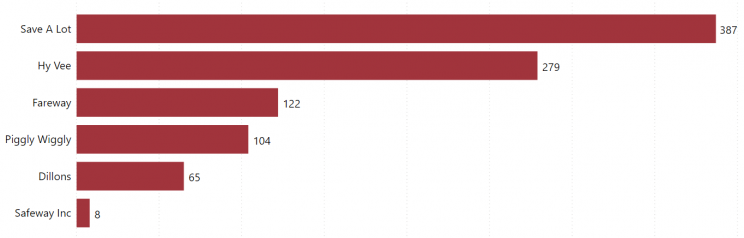

Midwestern Grocery Chains Map

Besides being present in the southern states, Save-A-Lot is ubiquitous in Michigan, Ohio, Indiana, and Illinois.

Hy-Vee and Fareway stores are almost equally scattered in Iowa. Piggly Wiggly dominates in Wisconsin, even though 80% of its locations are in the southern regions.

Number of Stores in the midwestern states by each Chain:

Save-A-Lot has the most number of stores with 387 stores in 6 midwest states. 52% of Hy-Vee stores are located in Iowa. Dillons, a division of Kroger has all 65 stores located in Kansas.

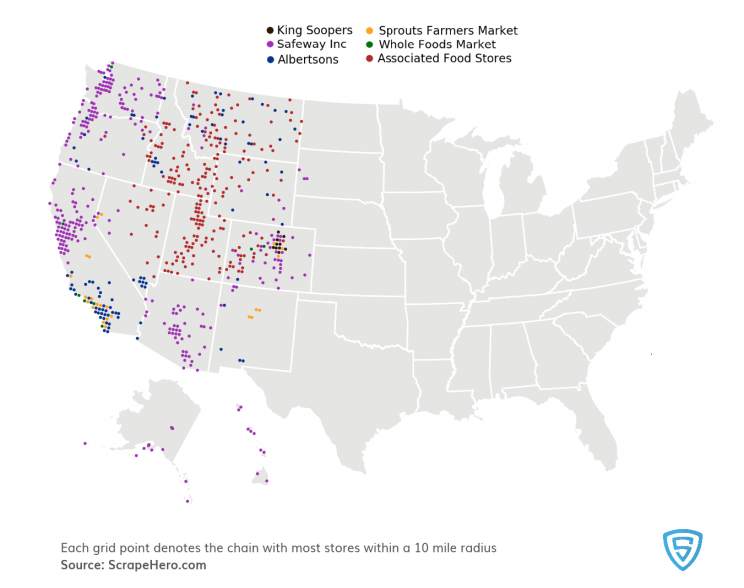

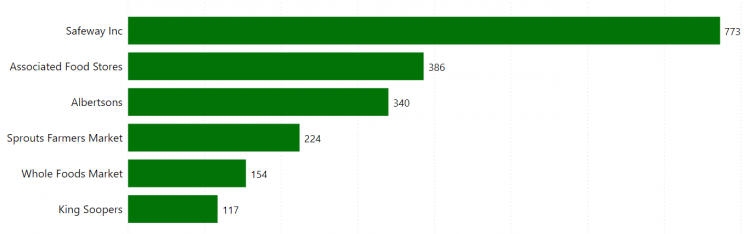

Western Grocery Chains Map

Safeway stores have a strong presence in the western states but with a better showing along the West Coast. Albertsons and Sprouts Farmers Market stores cover the lower parts of California.

Associated Food Stores dominate more in the states Montana, Idaho, Wyoming, Nevada, and Utah.

Number of Stores in the western states by each Chain:

There is a total of 773 Safeway stores located in the western states with the most stores in California (240). They also are present in two midwestern states as well. King Soopers, a supermarket brand of Kroger stores, has 116 locations in Colorado with only one in Wyoming.

The Amazon-owned Whole Foods Market may not appear much on the map but has 90 locations in California, and is planning on opening new stores.

Competition with Big Box Retailers

Regional chains struggle to keep up with big-box retailers and dollar stores as they offer more convenience, flexibility, and value. Another factor is digital technology, which is dramatically increasing price transparency, making customers check prices at multiple stores before going shopping.

Amazon quickly integrated e-commerce and physical shopping, where Whole Foods stores have Prime lockers that act as a convenient pickup depot for groceries and Amazon goods. Survival for regional chains depends on a commitment to strategies that will get brands closer to shoppers by building deeper customer relationships and creating physical in-store experiences such as clinics and pharmacy centers – moments that cannot be digitized.

We can help with your data or automation needs

Turn the Internet into meaningful, structured and usable data