The United States is the largest consumer of Childrenswear with 21% share of the global market and the global Childrenswear market is projected to be worth $142 Billion by 2025. This has led to brands having to incorporate data into their sales and marketing strategy to continuously be aware of their competitor’s product portfolio, clothing type, and pricing among others in order to stay ahead of the competition.

We analyzed the product data of Childrenswear (Girls, Boys, Babies) from websites of some popular clothing brands – GAP, Old Navy, H&M, Zara, Benetton, Lacoste, ChildrensPlace, Abercrombie, Ralph Lauren, and Adidas.

Quick Glance

- Babies have the largest selection of clothing (13.3k)

- Top wear is the largest Childrenswear clothing category (19.8k)

- Gap (8k) sells the most number of Childrenswear products

- Children’s Place is the cheapest Childrenswear brand with an average price of $17.06.

Did you know we have data sets for sale in our data store?

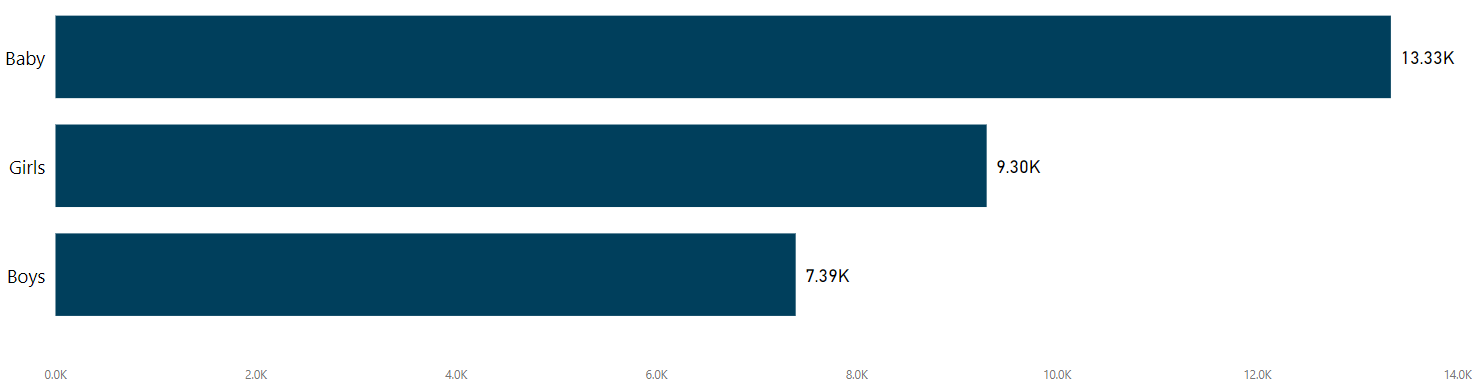

Which gender has the most selection in Childrenswear?

With all the data combined, babies (0-3 years) have the highest number of products (13.33k) compared to Girls (9.30k) and Boys (7.39k).

The baby apparel industry is expected to be worth $8.4 billion in 2019. The brands Gap, H&M and Old Navy are major competitors in baby apparel with Gap having the most number of baby items (4,867 products).

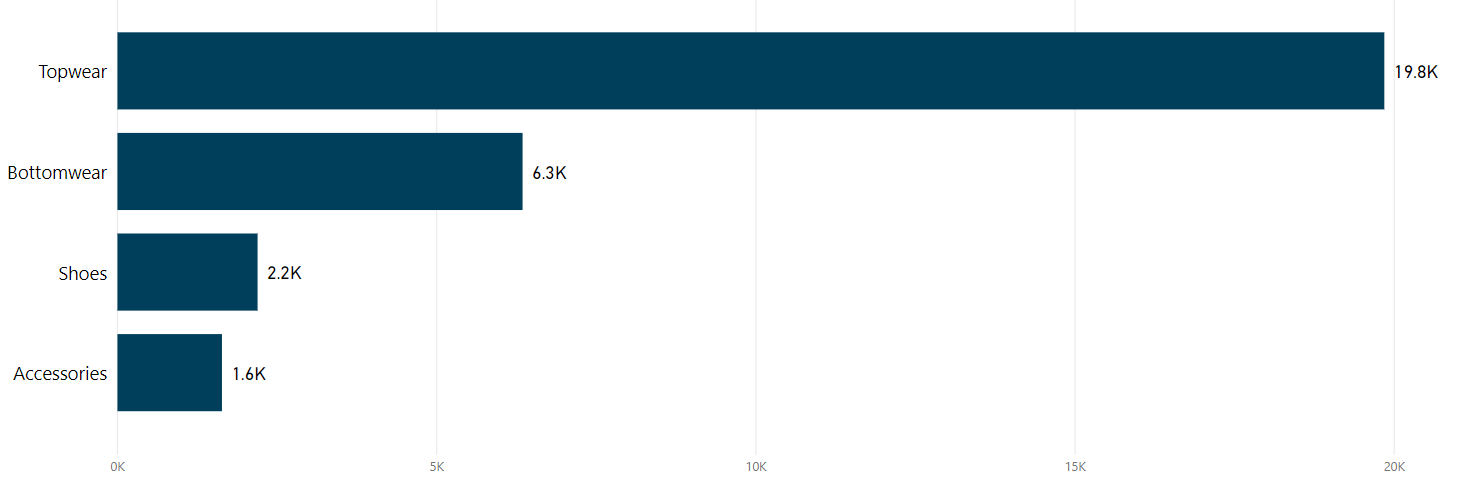

What type of clothing are Childrenswear brands selling the most?

In the chart below you can see that retailers sell top wear more than any other merchandise. Topwear composes 66% of total products across all websites.

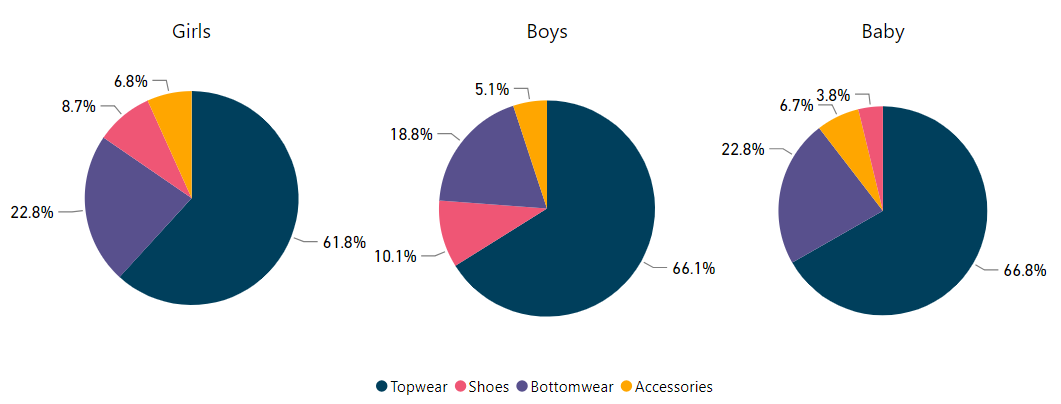

Here is how clothing types distribute across girls, boys and baby:

Every gender has more than 60% of their apparel under top wear. Boys have more selection for shoes compared to the rest. Whereas, babies and girls have almost the same percentage of bottom wear and accessories.

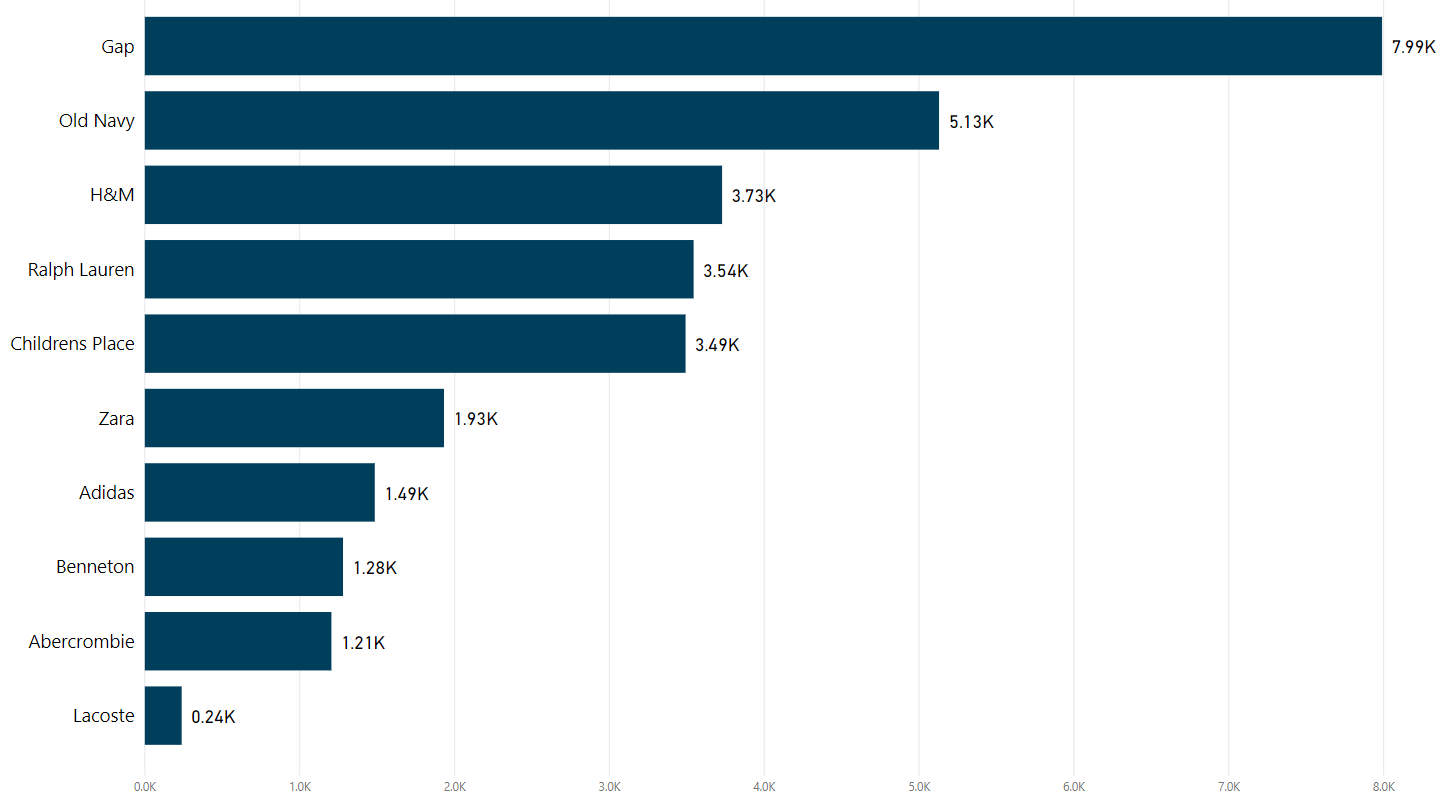

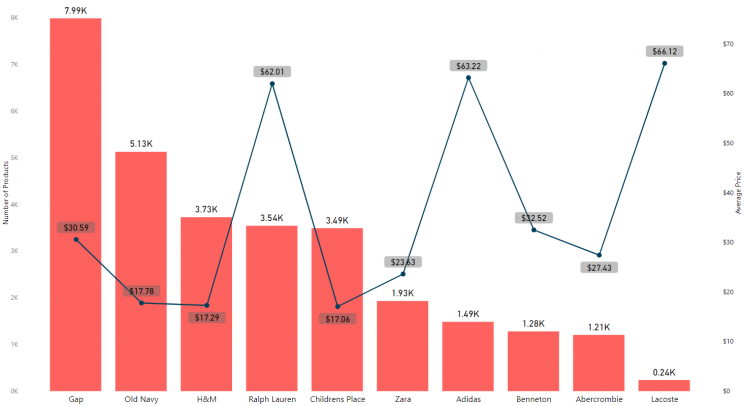

Which brands sell the most Childrenswear products online?

Gap has 7.9k products listed, making it the brand with the most number of products on sale. Old Navy, a child company of Gap comes second with 5.1k products listed. Whereas H&M with 3.7k products is third. Lacoste, Abercrombie, and Benneton have the least number of products.

Would you like to monitor your competitor’s brands or create a custom monitoring solution for your needs: How to do Brand Monitoring right

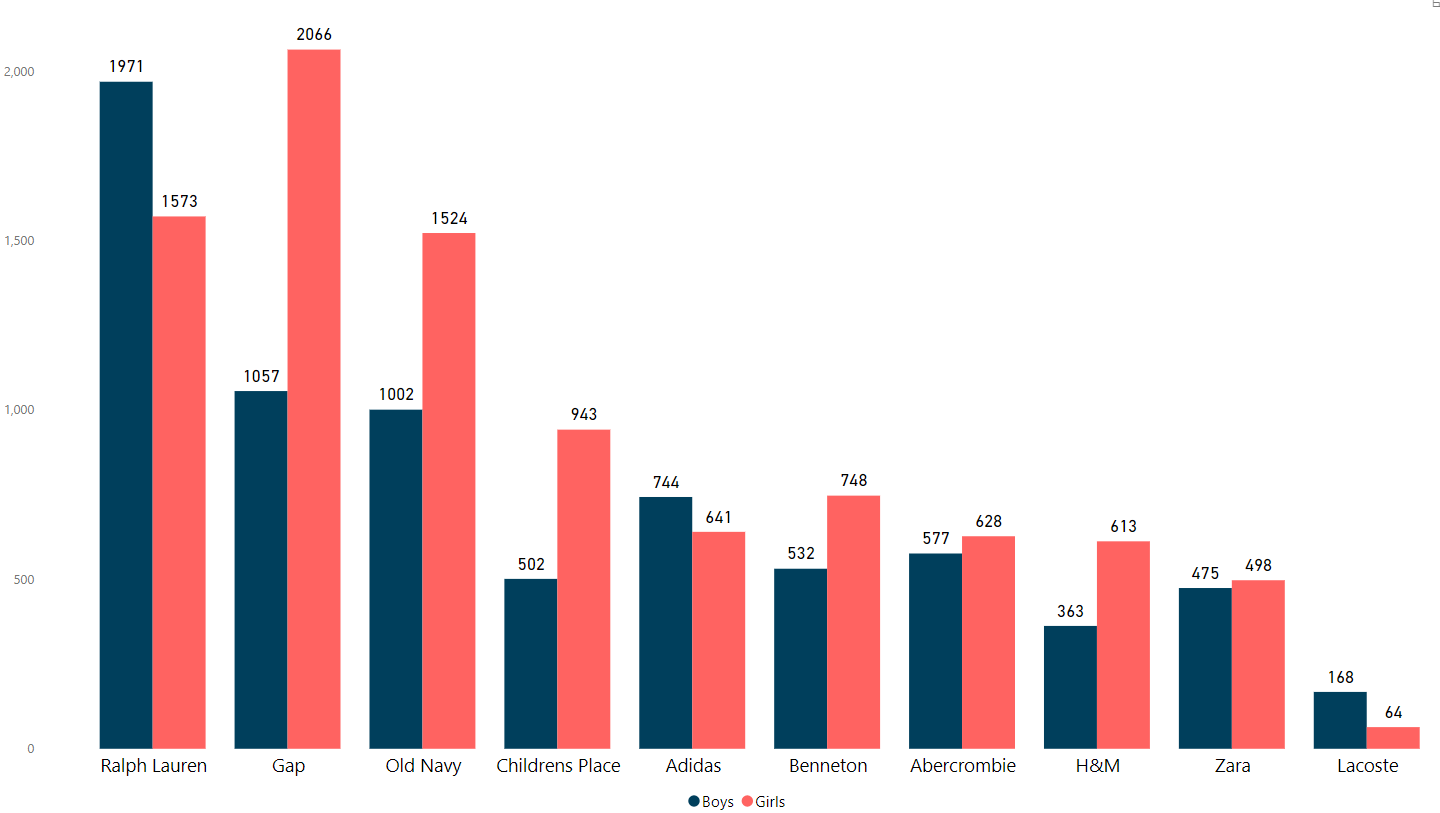

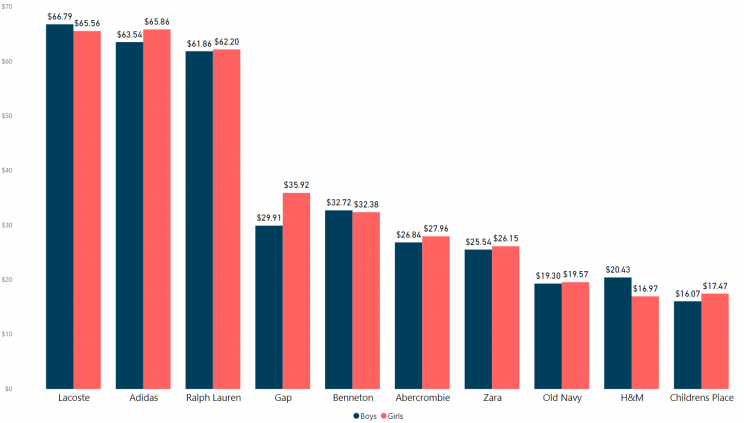

Which brand sells the most number of clothing for Girls and Boys?

Gap has the most number of clothes for girls with 2,066 products and Ralph Lauren has the most number of clothing for boys with 1,971 products.

Most brands lean toward girls, with Ralph Lauren, Adidas and Lacoste being the only brands that have more selection for boys than girls.

Cheapest Childrenswear Brand

Children’s Place has the lowest average price of $17.06. H&M ($17.29) and Old Navy ($17.78) have the second and third lowest average pricing respectively. Lacoste has the highest average pricing as well as the lowest number of products listed.

Adidas has a higher average price which can be attributed to their ingenious sneaker collections and innovative manufacturing technologies. Showing that while children’s clothing is available at moderate prices, people will pay more for products from high-end brands.

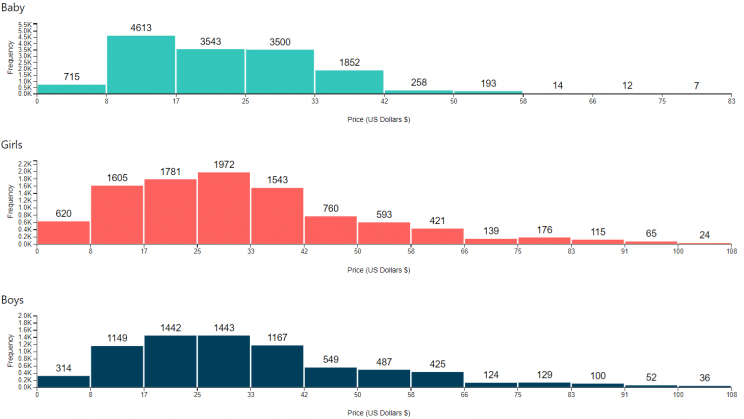

How does Childrenswear price vary across gender?

While Girls have more products in the $8 to $33 range, Boys have the most number of products in $17-$42 price range.

Baby clothes are the cheapest with a maximum price of $83 and most of them fall in the $8-$25 price range.

In the chart below, seven out of the ten brands have a slightly higher average price for girls than boys, but most brands have less than a $3 price difference. Gap, is the only brand where the average price difference is more than $5. The smallest discrepancy is for Old Navy ($0.27).

The Effect of Online Shopping

Some of the United States’ biggest retailers are closing stores or declaring bankruptcy in recent months due to dwindling sales. 4,810 store closures have been announced by retailers in 2019. While Gap Inc. is planning to shut 200 of its brand’s stores over the next two years, Abercrombie & Fitch, Children’s Place, and other chains have announced more store closings in 2019.

E-commerce sites like Amazon have made it difficult for retailers to attract customers to their stores. Many companies are changing their sales strategies, turning to sales promotions and increased digital efforts to lure shoppers while shutting down brick-and-mortar locations. A large number of working parents are finding it difficult to find the time to shop for their children. The convenience of online delivery, preferences, and choice of products has resulted in more consumers to purchase online. As the demand for more clothing online will continue to rise, the trend of traditional retailers moving to online stores will undoubtedly accelerate.

If you need location data for analysis, you can download retail store locations data from our data store

We can help with your data or automation needs

Turn the Internet into meaningful, structured and usable data