Alternative data is quickly becoming more important in finance.

A recent study by Deloitte found that companies that provide alternative data are likely to earn more money than those that only provide traditional financial data within the next six years.

This is because investment companies are realizing that traditional data alone doesn’t give them the whole story about what’s happening in the market.

Read on to understand what alternative data is, why it is important in finance, and the essential role of web scraping for alternative data in finance.

Want to use alternative data to make better financial decisions?

What is Alternative Data?

Alternative data refers to information collected from sources outside traditional financial reports and stock market data.

Unlike traditional financial data, which is backward-looking (e.g., quarterly earnings reports), alternative data is often real-time, giving quicker and more relevant insights.

To give you an insight, here’s an anecdote from the past.

Back in 2015, a company called Eagle Alpha predicted that GoPro, a popular action camera maker, wouldn’t meet its sales goals for the quarter.

Most stock recommendations were advising investors to buy GoPro stock, but Eagle Alpha said to stay away.

And they were right! GoPro’s actual sales were lower than they had predicted, proving Eagle Alpha’s prediction correct.

The reason behind Eagle Alpha’s prediction wasn’t better analysts or some higher intuition; it was better data.

Instead of just looking at the usual financial reports, they also collected data from websites selling electronics and many other sources. This extra information helped them make a more accurate prediction.

Sources of Alternative Data

To effectively gather alternative data, it’s essential to identify reliable sources. Here are common sources used for financial insights:

- E-commerce Websites: Pricing trends, product reviews, and sales data provide insights into consumer behavior and market demand.

- News Websites: Real-time updates and sentiment analysis on companies and industries.

- Social Media Platforms: Twitter, LinkedIn, and Facebook are rich sources for gauging public opinion and market sentiment.

- Public Records: Government and regulatory filings, such as SEC reports, offer valuable insights.

- Web Traffic Analytics: Tools like SimilarWeb or Alexa provide metrics on website popularity and user engagement.

- Satellite Imagery Providers: Images of industrial activities, agriculture, and shipping routes provide macroeconomic insights.

- Mobile App Data: App stores and analytics platforms reveal download trends and user activity.

Alternative data is important in the financial sector, but understanding how it works with traditional data is key.

Traditional data (like stock prices) provides the foundation, while alternative data adds crucial insights.

Why Does Web Scraping for Alternative Data in Finance Matter?

Web scraping for alternative data in finance offers many benefits:

1. Access to Unique Insights: Traditional financial data sources, such as earnings reports and stock prices, provide a limited view of market conditions.

In contrast, alternative data can include information from social media, e-commerce sites, and other online platforms.

This variety allows investors to gain insights into consumer behavior, market trends, and even public sentiment about specific companies.

2. Real-Time Information: The financial markets operate at a rapid pace, and having up-to-the-minute information can be crucial.

Web scraping enables investors to gather real-time data, allowing them to react quickly to market changes.

For example, a sudden spike in social media mentions about a company could indicate a shift in public perception, prompting investors to buy or sell stocks accordingly.

3. Enhanced Predictive Analytics: By combining traditional financial metrics with alternative data, firms can create more accurate predictive models.

This means they can forecast market trends and company performance with greater precision.

For instance, scraping product reviews can provide insights into consumer satisfaction and potential sales figures before quarterly earnings reports are released.

If you are looking to build AI solutions such as predictive analytics, recommendation systems, etc, ScrapeHero’s custom AI solutions is a recommendable option.

4. Improved Risk Management: Understanding market sentiment and consumer behavior helps financial professionals identify potential risks.

For example, an analysis of the data collected reveals that a company is facing negative sentiment on social media, it may signal trouble ahead, allowing investors to adjust their strategies proactively.

5. Cost-Effective Data Collection: Traditional methods of gathering data often involve significant costs and time delays.

Web scraping automates the data collection process, making it faster and more affordable.

But, are you confused about whether to build an in-house web scraping solution or outsource to a web scraping service provider?

Hop on a free call with our experts to gauge how web scraping can benefit your businessIs web scraping the right choice for you?

Use Cases of Web Scraping for Alternative Data in Finance

Web scraping for alternative data has a wide range of applications in the financial industry. Below are some key use cases:

- Predicting Stock Performance: Investment firms scrape product reviews, online sales data, and web traffic metrics to predict how specific companies or sectors will perform in the stock market.

- Economic Indicators: Satellite imagery and shipping data scraped from online sources help financial analysts evaluate global economic trends.

- Competitive Analysis: Web scraping alternative data enables hedge funds and investment firms to track competitors by analyzing web traffic, pricing strategies, and product launches.

- Retail Sector Trends: Retail investors use data from e-commerce platforms and online shopping trends to predict consumer behavior. Scraping sales promotions or product availability provides clues about a retailer’s operational success.

- Fraud Detection and Risk Management: Alternative data from online reviews, news reports, and social media can be used to detect anomalies, helping organizations identify risks and prevent fraud.

Challenges in Web Scraping for Alternative Data in Finance

Collecting alternative data isn’t without its challenges. Here are a few common obstacles to expect on the way:

- Legal Compliance: When web scraping for alternative data in finance, one must ensure that their data collection practices comply with regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

- Data Accuracy: Raw data can be messy or incomplete. Therefore, it is essential to verify the accuracy of the information collected.

- Handling Large Volumes of Data: Gathering and processing massive datasets requires advanced infrastructure.

- Ethical Considerations: Transparency and responsible data collection are critical.

Companies need to consider the ethical implications of using certain types of data and ensure they respect user privacy.

Therefore, for those looking to integrate alternative data into their financial analysis, partnering with a professional web scraping service like ScrapeHero is the most effective approach.

Let us see why.

Why Choose ScrapeHero for Web Scraping for Alternative Data in Finance Sector

Choosing the right partner for web scraping alternative data is critical for success in the finance sector. Here’s why ScrapeHero stands out:

1. Dedicated Services for Alternative Data: Scraping alternative data is one of ScrapeHero’s dedicated services, with solutions specifically designed to meet the needs of financial professionals.

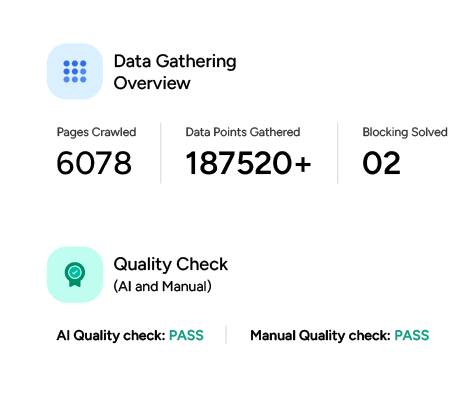

2. Comprehensive Solutions: ScrapeHero provides end-to-end web scraping services, from data extraction and cleaning to integration. This ensures you receive actionable data tailored to your needs.

3. Legal and Ethical Compliance: With a deep understanding of regulations like GDPR and CCPA, ScrapeHero ensures all data collection activities meet the highest legal and ethical standards.

4. Customizable Services: Every financial institution has unique needs.

ScrapeHero offers fully customizable scraping solutions, enabling businesses to collect data relevant to their specific goals, whether it’s tracking e-commerce trends or analyzing satellite imagery.

5. Scalable Infrastructure: Handling large datasets is no challenge for ScrapeHero.

Our robust infrastructure supports scaling to meet the demands of growing businesses and complex projects.

6. Proven Expertise: With years of experience in web scraping across industries, ScrapeHero delivers data that empowers financial analysts, hedge funds, and portfolio managers to make smarter, faster decisions.

Why worry about expensive infrastructure, resource allocation and complex websites when ScrapeHero can scrape for you at a fraction of the cost?Go the hassle-free route with ScrapeHero

Conclusion

In conclusion, alternative data is changing how finance works by providing unique insights, real-time information, and enhanced predictive analytics.

Traditional financial data only offer a limited perspective, but alternative data provide a much deeper understanding of market conditions.

Web scraping is the best way to gather alternative data in finance by automating the data collection process.

However, web scraping can be challenging. Therefore, partnering with a reliable service for web scraping for alternative data in finance, like ScrapeHero, can help you overcome these challenges.

FAQ

Yes, using alternative data can lead to more accurate financial forecasting.

Alternative data provides a broader range of information, which helps in understanding market conditions better.

When combined with traditional financial metrics, alternative data enables firms to create stronger predictive models.

Alternative data is crucial because it offers insights that traditional financial data can’t provide.

It offers a more comprehensive understanding of market conditions, leading to better predictions, risk management, and competitive analysis.

Web scraping for alternative data in finance sector can be from various online sources, including:

● E-commerce Websites

● News Websites

● Social Media Platforms

● Public Records

● Web Traffic Analytics

● Satellite Imagery Providers

● Mobile App Data

Alternative data in banking refers to any information gathered from non-traditional sources to make better financial decisions.

This could include data about consumer spending habits from e-commerce sites, social media sentiment about a company, or even satellite imagery to assess economic activity.

This data helps banks evaluate credit risk, understand market trends, and offer better-personalized services.

Web scraping for alternative data in finance sector is crucial because it provides:

● Unique Insights

● Real-Time Information

● Enhanced Predictive Analytics

● Improved Risk Management

● Cost-Effective Data Collection